Income and Development Fund

Income and Development Fund

Our Income and Development Fund provides access to a diversified portfolio of institutional grade real estate assets including income-producing (commercial/industrial/lending) as well as development projects. Investors receive cash flow from rental income and interest from loans, capital appreciation from growth of value of properties and special distributions from development projects. Targeted Annual Net Return of 12%‑16% (over 10-year period). See Offering Memorandum for more details.

Income & Development Fund Strategy:

Focuses on prime properties in urban centers across North America

Diversifies risk across multiple asset classes

Offers attractive total and risk-adjusted returns

Deploys capital to reposition assets and enhance value

Core Investment Categories

How does your investment grow?

Equiton’s Income and Development Fund generates returns through a combination of the following factors:

Income Generation

Regular income stream generated from building tenants paying rent.

Interest Generation

Interest generated by loans (mortgages, land loans, construction loans) is distributed to investors.

Builds Equity

Paying down the mortgage of the properties results in increased equity.

The property value increases over time and as improvements are made.

Special Distributions

The Income and Development Fund provides special distributions when development projects are completed.

Properties included in this Fund

Commercial Property

1960 – 1980 Hyde Park Road London, Ontario

A multi-tenanted retail plaza anchored by Wendy’s and CIBC

100% leased as of purchase date (December 10th, 2021)

Property Size: 19,565 sq. ft. of retail space on 2.63 acres

Development Project

710 Woolwich Street Guelph, Ontario

Multi-phased mixed use (residential + retail)

A new format retail store and 96 upscale modern townhomes

Phase One | New Format Beer Store

Phase Two | Upscale Modern Townhomes For Sale

Estimated Completion Value: $61M^

Development Project

2257 Kingston Road Toronto, Ontario

Multi-phased mixed use (residential + retail)

12-storey mid-rise modern and urban condo

Approx. 329 residential units and 7,300 sq. ft.

of commercial spaceThe Fund has an 11% stake in this development

Estimated Completion Value: $285M^

Development Project

875 The Queensway Toronto, Ontario

Multi-phased mixed use (residential + retail)

11-storey mid-rise modern and urban condo

Approx. 186 residential units and 2,500 sq. ft.

of commercial spaceThe Fund has an 9% stake in this development

Estimated Completion Value: $155M^^

^Current estimated total completion value

^^ Per initial underwriting

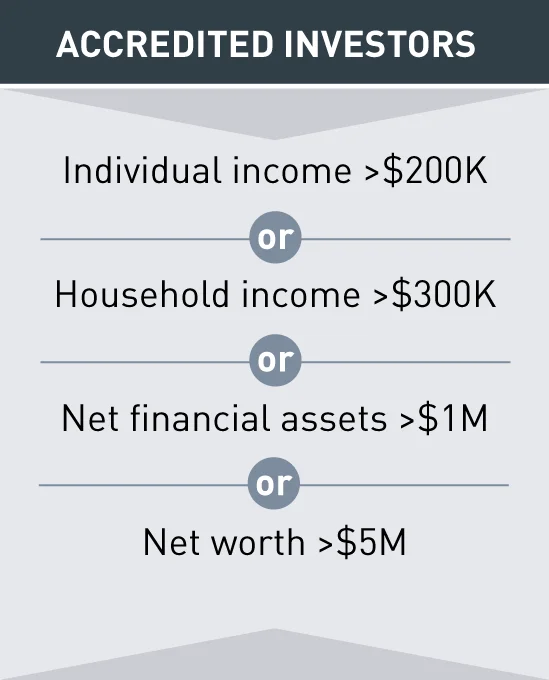

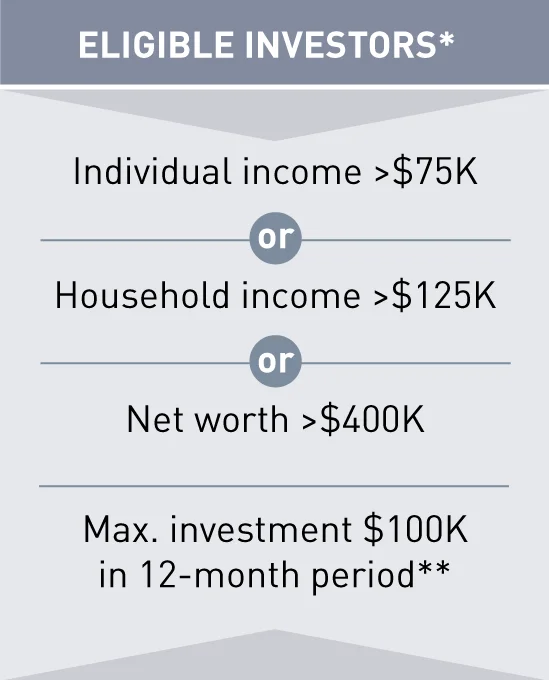

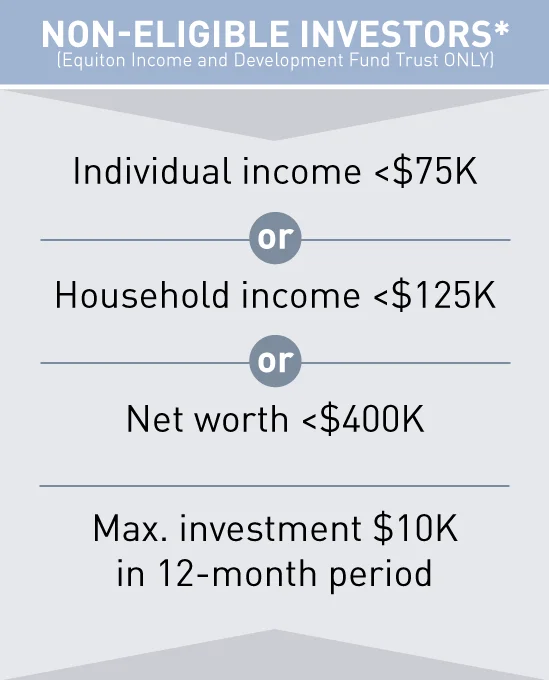

Who Can Invest?

*Varies by province, subject to suitability limitations.

**When working with an Advisor.

Equiton Investment Specialists

Contact our team today to learn more about how our investment solutions can help you invest like the wealthy and add diversity to your portfolio.

For general inquiries: inquiries@equiton.com

Senior Associates, Private Capital Markets

Associates, Private Capital Markets

Questions?

Contact us anytime to learn more about private real estate investing.