Rental Apartment Fundamentals Remain Resilient Amid a Changing Housing Market

The Canadian housing market is experiencing a period of adjustment. A surge of new supply and a temporary softening in home prices and rents in some major markets have raised questions about momentum. At the same time, immigration has slowed from recent peaks and affordability has improved briefly, easing some immediate pressures. Yet these shifts are best understood as cyclical fluctuations, with the sector showing early signs of moving back toward longstanding norms.

For rental markets across Canada, the shifts are especially evident. As housing completions and population growth trend back toward more typical levels, the underlying supply-demand gap is set to widen, ownership affordability will remain constrained, and demographic growth will continue to add pressure. Taken together, these conditions reinforce the resilience and growth potential of Canadian multifamily rentals.

Below, we examine the key drivers behind a positive outlook for rental market fundamentals, which position private apartment funds as a dependable source of housing and a reliable solution for investor returns.

Broader housing gap projected to remain unresolved

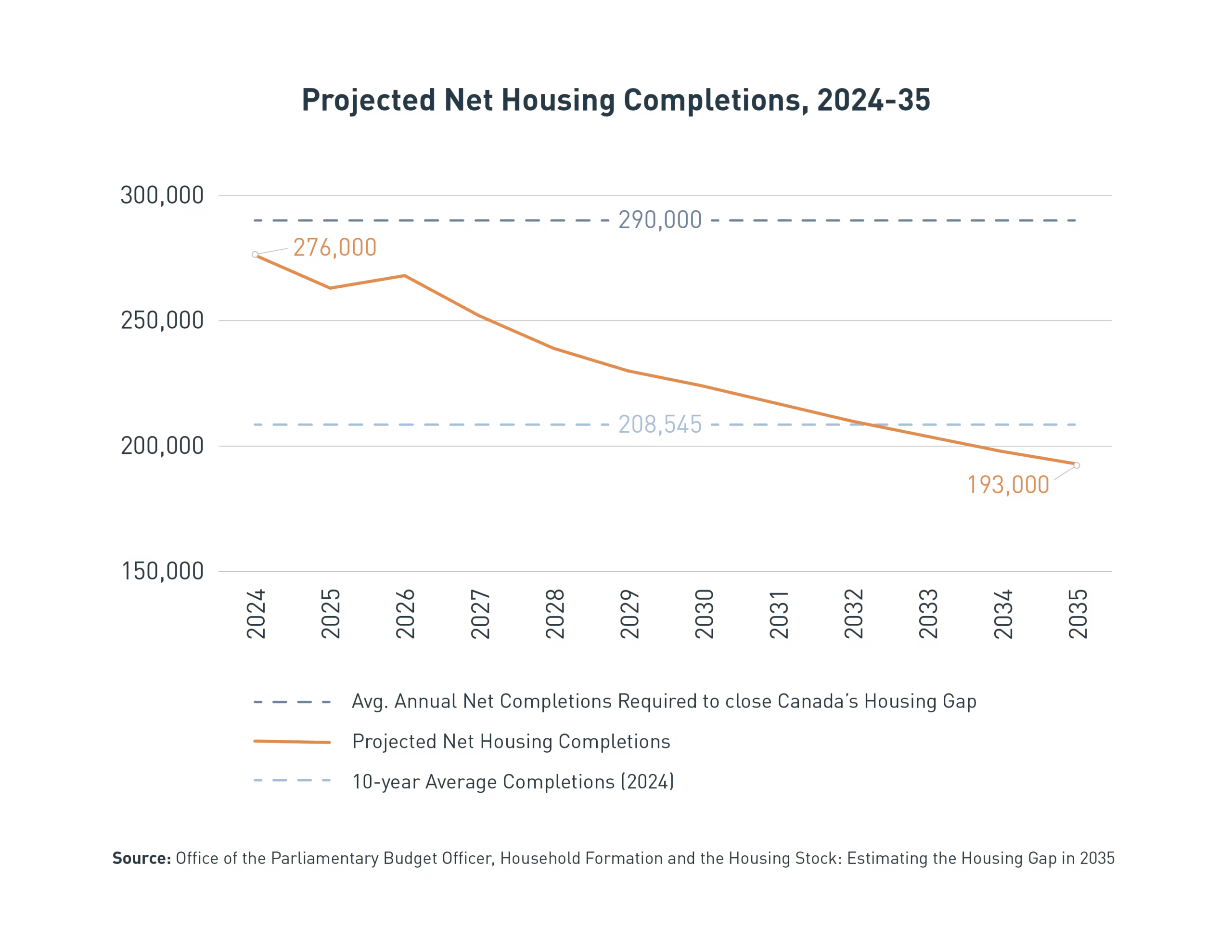

In 2024, Canada achieved a record 276k housing completions across all housing types, providing moderate price relief for homebuyers and renters alike. Yet, according to a report by the Office of the Parliamentary Budget Officer (PBO), these conditions are expected to be temporary.

The report estimates that completions could slow over the next decade, falling short of the 290k-unit pace needed to close Canada’s accumulated housing supply-demand gap and even below the current 10-year average. Building the 3.2M net new housing units needed to meet demand by 2035 would require construction to surpass the 2024 record every year for 11 consecutive years — an unprecedented pace the current outlook does not support, even with announced policy changes aimed at stimulating housing construction.

The PBO’s outlook echoes similar findings from the Canada Mortgage and Housing Corporation (CMHC), which estimated that Canada needs to build 2.6M additional units by 2035 to close the housing gap and, in 2023, projected it required 3.5M additional units to restore housing affordability.

Surging rental construction also unlikely to meet demand in key markets

Let’s look closer at rental apartment construction. Rental starts hit record levels in 2024, supported by government policy, surging renter demand, and elevated rent growth at the time of planning. Rentals continue to play a major role in total homebuilding, which reached 290k+ starts in the year ending July 2025, according to TD Economics.

However, the CMHC observed severe regional discrepancies in its Fall 2025 Housing Supply Report, with new starts in more active markets balancing declines in cities like Toronto and Vancouver. This regionality is likely to show up in completions, increasing pressure in some of Canada’s highest-demand markets.

In the GTA, for example, a joint white paper by Urbanation, BILD, and Finnegan Marshall forecasts that in the next 10 years, rental demand will outstrip available supply by approximately 121k units, effectively doubling the existing shortfall and underscoring persistently tight conditions ahead. This finding is consistent with national research from Concordia University, supported by Equiton, which projects that undersupply relative to population growth is a key driver of projected rental growth in Toronto and its surrounding submarkets.

Population growth to remain elevated compared to G7 peers

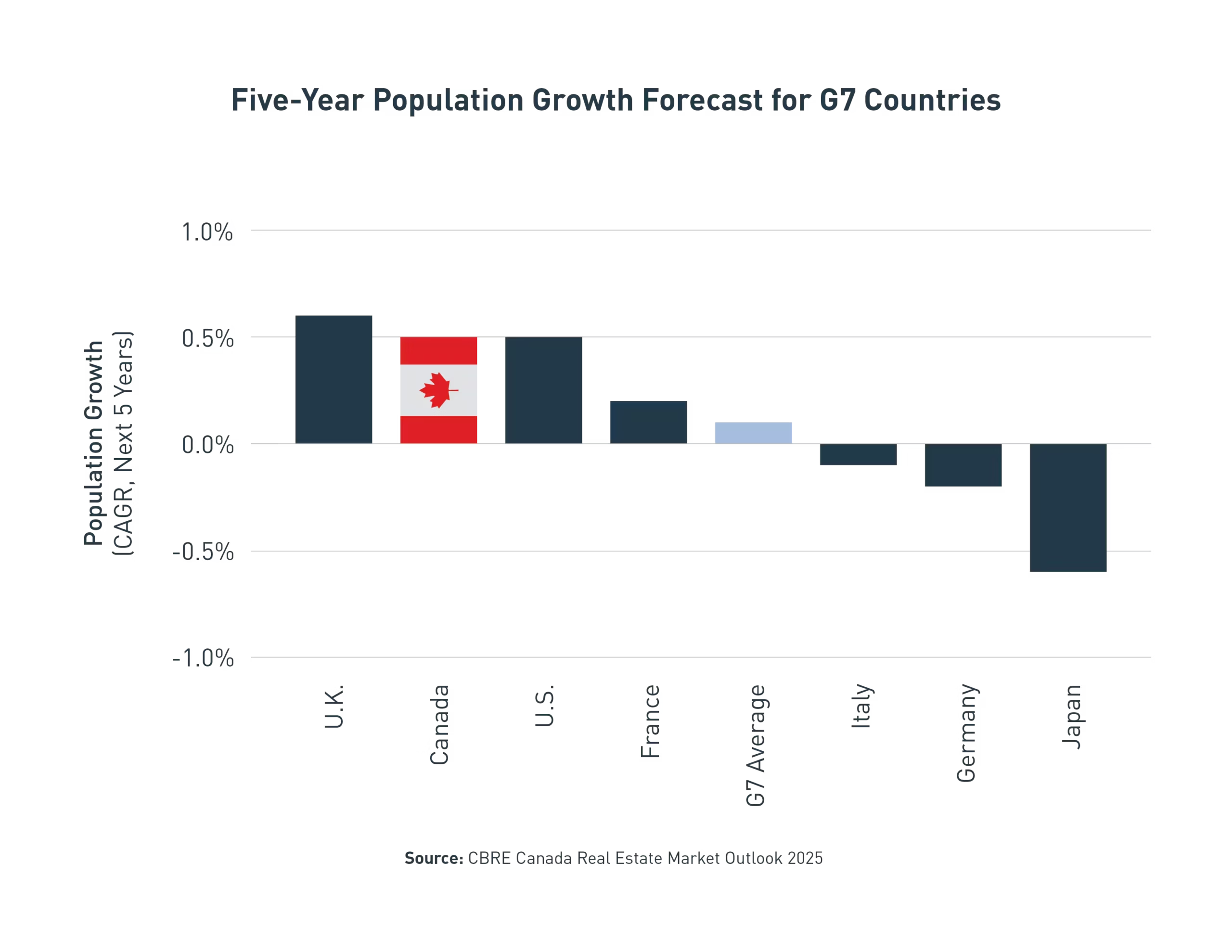

In 2022 and 2023, Canada’s population growth surged to roughly 3.2% annually, according to Statistics Canada, an unprecedented rate among peer countries. By late 2024, this growth slowed to its weakest quarterly pace in five years before effectively flattening in the first quarter of 2025. This pullback stems largely from government measures to curb non‑permanent residents. Yet, as with the prior highs, this extreme slowdown is expected to be temporary.

Over the past decade, the annual population growth rate has hovered around 1.3%, making Canada one of the world’s fastest-growing advanced economies. While a return to this rate may not materialize in the near future, RBC Global Asset Management and CBRE forecasts anticipate growth stabilizing at about 0.5% annually through 2029. This remains a globally significant rate, placing Canada as the second-fastest growing G7 country. As in previous decades, Canada’s attractiveness to immigrants, foreign students, and job seekers will continue to drive new demand for apartment rental housing.

Entrenched unaffordability of homeownership

Meanwhile, even at the strongest affordability levels recorded by RBC in three years, more than 55% of the median Canadian household’s pre-tax income is still required to cover average homeownership costs. In Toronto, 68.3% of a median household’s pre-tax income would need to be dedicated to servicing ownerships cost of the average home. In Vancouver, the share rises to an untenable 92.7%, putting homeownership out of reach for many.

Combined with factors like return-to-office mandates rekindling housing demand in urban cores, this persistent — and generally increasing — affordability squeeze is expected to support the outlook for rental demand, according to Altus Group.

Emerging rental development opportunities

Some opportunities have become even more attractive in this environment. Driven by easing material prices, reports suggest that construction cost growth has moderated from double-digit spikes in 2021-2023 to roughly the pace of inflation. The Toronto area, a key high-demand market, has even experienced an outright decline in construction cost pressures, while undeveloped land values there decreased 14% Y/Y and 37% from their 2021 peak. Suburban markets around the GTA saw an even sharper correction, down 29% Y/Y and 38% from peak levels. For funds with the in-house expertise to manage development projects, rental development can represent a significant discount to acquiring a comparable completed building in certain high-demand markets.

Near-term fluctuations, long-term growth

While each of these drivers is experiencing short-term fluctuations — more recently tempered by catalysts such as stabilizing property cap rates and a renewed cycle of interest rate cuts — the underlying tailwinds for rental housing remain as strong as ever. As market dynamics continue to evolve, rental apartment funds are well positioned to deliver long-term growth and investment stability through upcoming market cycles.