Four Benefits of Alternative Investments

Alternative investments are financial assets that don’t fit into conventional investment categories9 – things like private equity, venture capital, commodities, and real estate.

Alternative investments can provide diversification and are often less volatile than other investments – particularly those traded in the stock markets – which makes them a key part of any portfolio. In this case we are going to focus on private multi-residential properties.

- They can achieve comparable total returns with less volatility

- They can provide better downside protection

- They are a proven hedge against inflation

- They are tax efficient

As investors continue to worry about volatility in the traditional public markets, they are beginning to look for alternative ways to generate stable income, preserve their capital, protect against market volatility, and achieve an attractive total return. Many investors are realizing that simply spreading their stock holdings across more geographic regions or sectors is not really providing them with the diversification and true protection they’re looking for. When things go wrong (and that seems to be happening more and more), the selloff in public equities is sharp and basically indiscriminate, meaning the vast majority of publicly traded stocks take a beating.

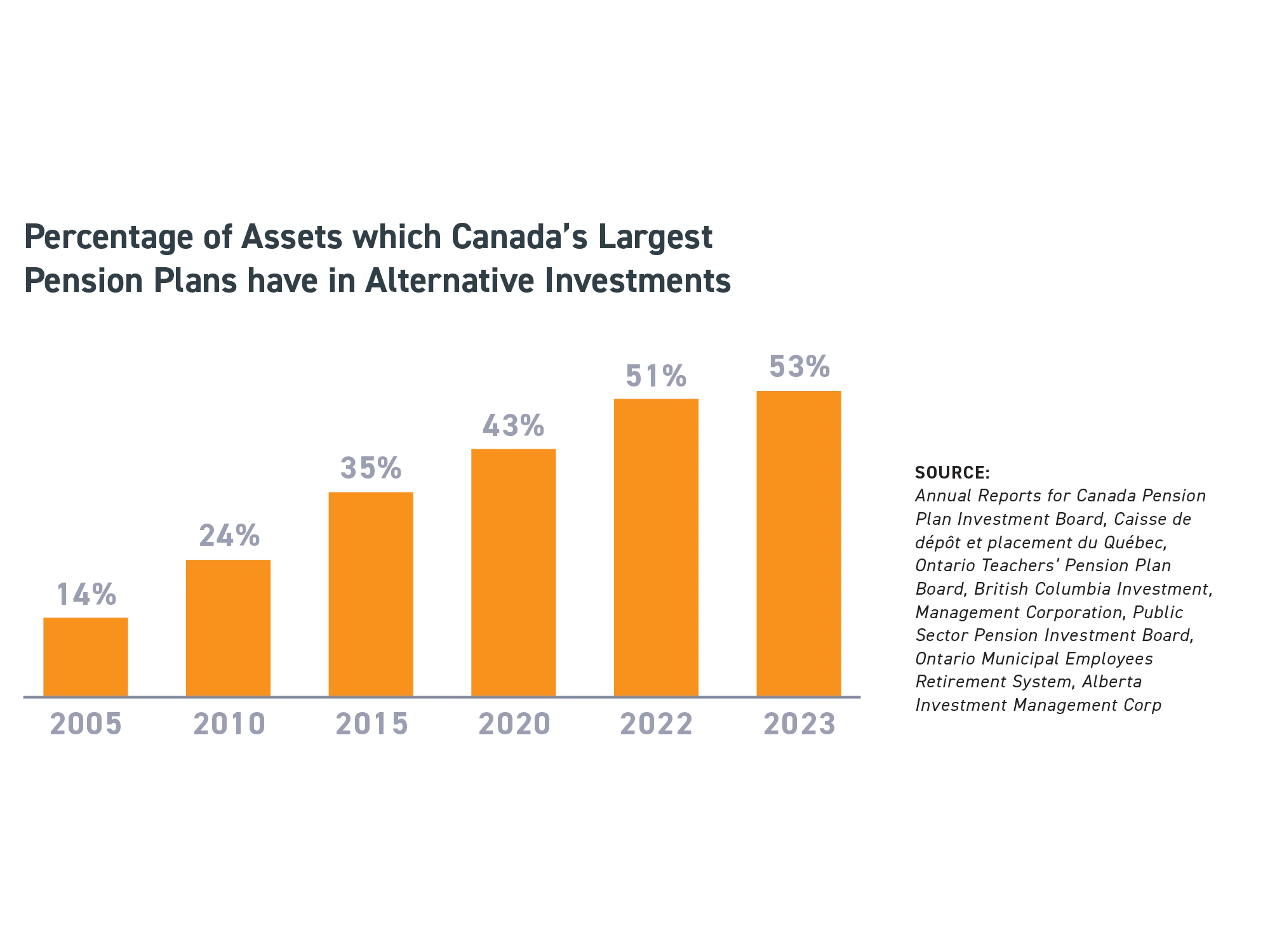

Investment professionals often turn to the leading pension plans and endowment funds for insight into how to better protect their clients from volatility. After enduring numerous stock market roller coasters, managers of pension plans and endowment funds found it was becoming harder to match their very predictable payout streams with the income streams being generated from their traditional investments. They began to look for ways to significantly reduce the volatility of their investments, so they could ensure they could increase their ability to meet their future payout commitments. Over the last 20 years, CPP, OMERS, OTPP, CalPERS, Yale Endowment, and Harvard Endowment have all substantially increased their relative holdings in real estate and other alternatives to reduce the overall volatility and increase the returns of their investment portfolios.

Below you can see the dramatic increase in alternative investments in the seven largest pension plans in Canada, which together manage more than C$1.7 trillion.

Advantages of multi-residential properties

Private real estate, such as multi-residential properties, is a proven class of alternatives that offers investors a unique investment opportunity and has the potential to create returns through three sources:

- Consistent cash flows from operations

- Increases in equity from mortgage principal repayment

- Potential increases in property value over time.

We see four key advantages that private multi-residential properties have over traditional investments9.

Advantage #1: Higher total returns with less volatility

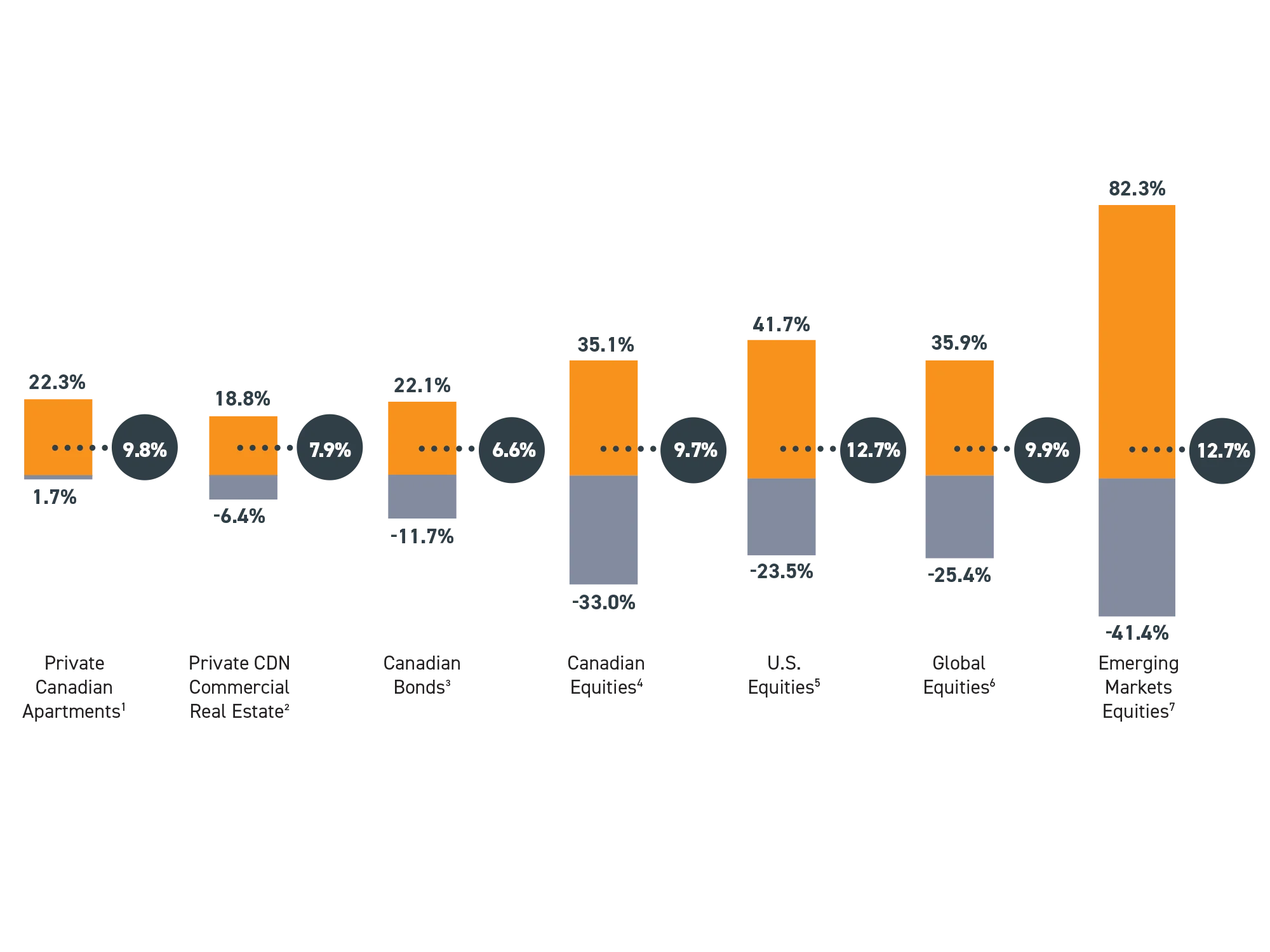

The performance of multi-residential properties can be analyzed by reviewing the Private Canadian Apartments1 index. Over the past 30+ years, Private Canadian Apartments have not only outperformed Canadian Bonds3 and Canadian Equities4 ,but they have also never had a year in which their annual return was negative.

The lowest annual return for Private Canadian Apartments was a positive 1.7%, while the lowest annual return for Canadian Equities was negative 33%.

Advantage #2: Better downside protection

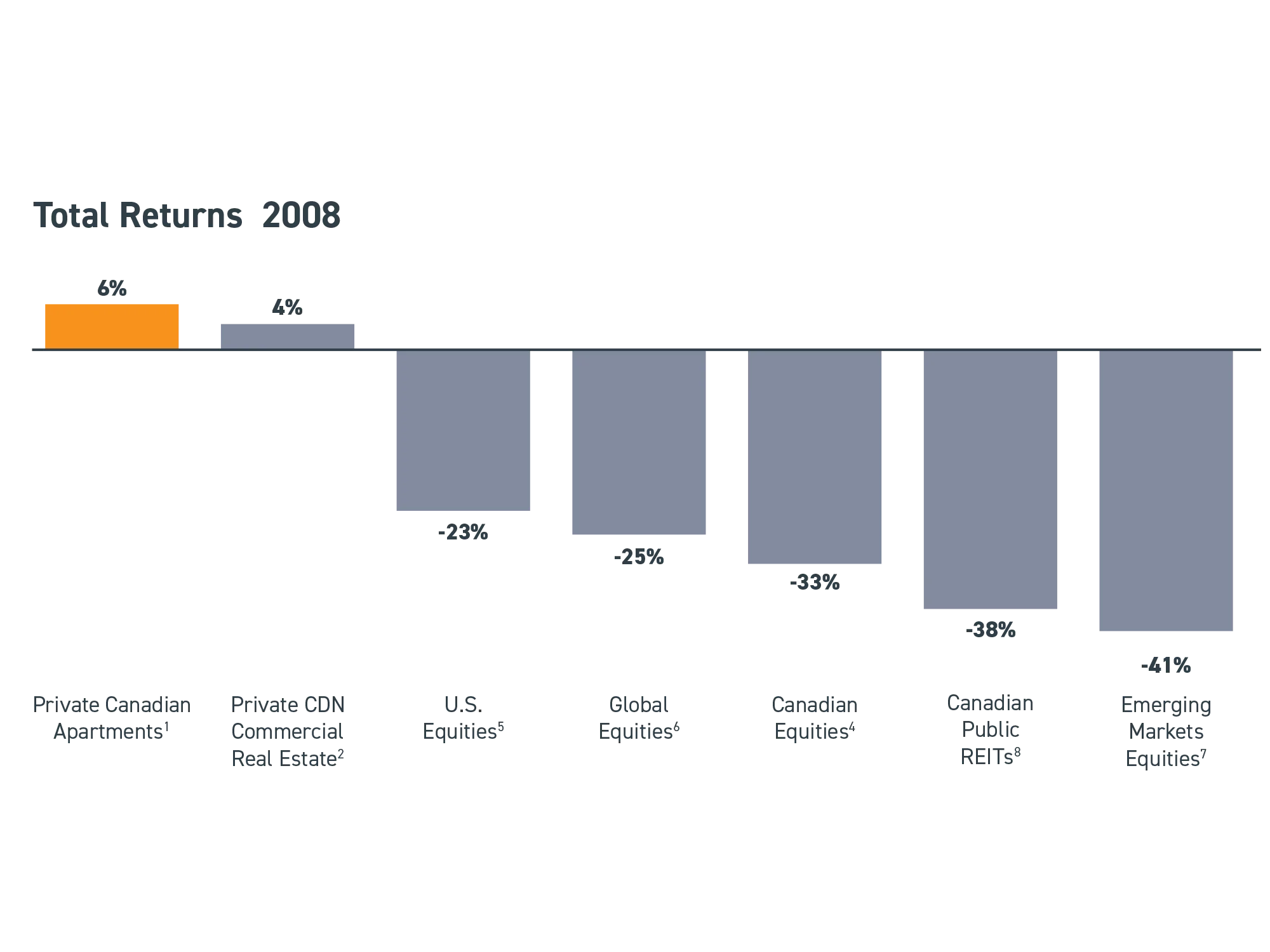

Over the last 30+ years, Private Canadian Apartments have provided investors with significant downside protection. Over this period, Private Canadian Apartments have never had a negative annual return, while in contrast, all major equity markets (and even Canadian Bonds) have had numerous negative annual returns.

During the Financial Crisis of 2008, the single worst year in global investing since the 1930s, Private Canadian Apartments posted a positive return of roughly 6%. Even during a time of great uncertainty and upheaval, returns to investors were still positive.

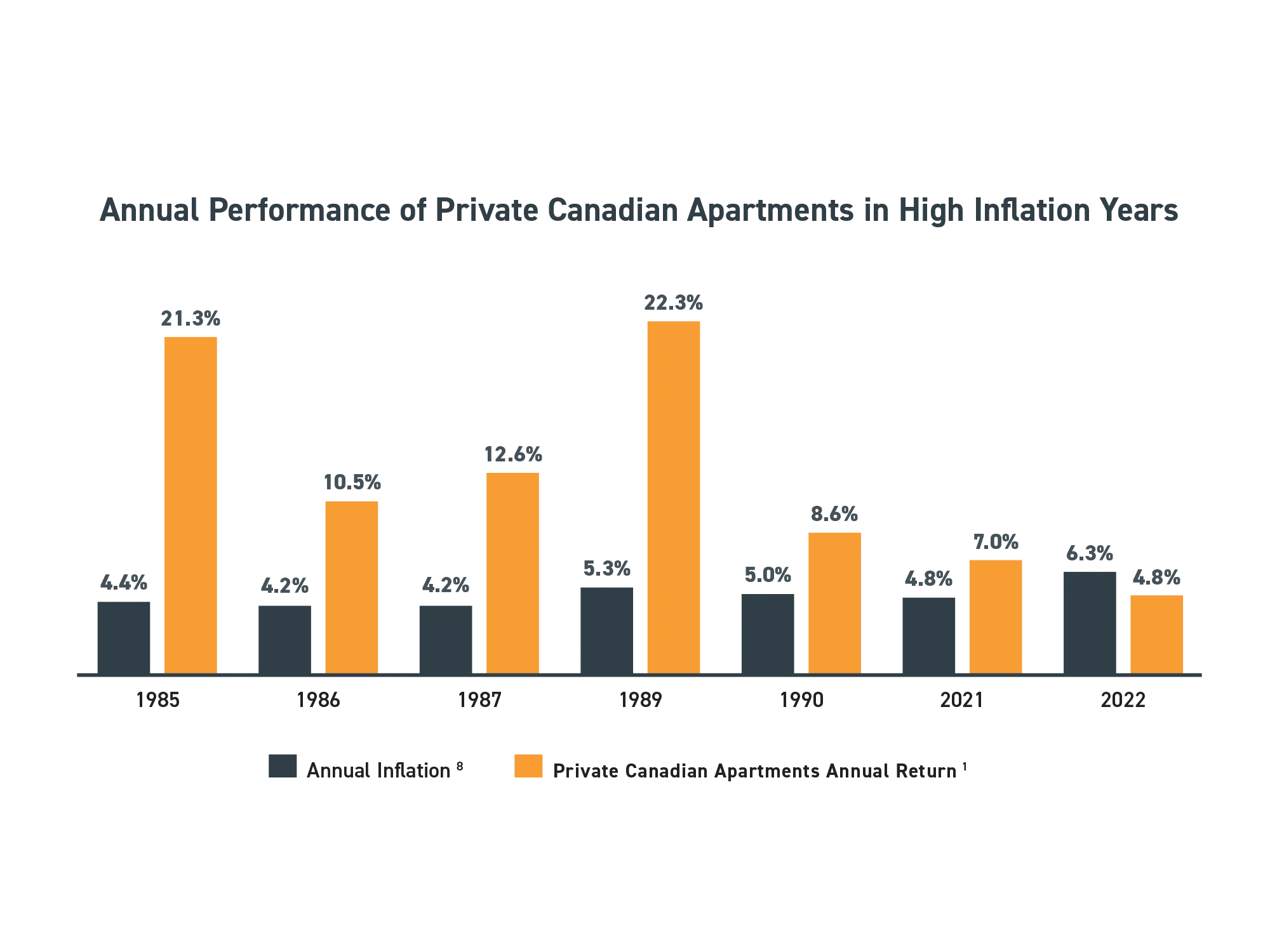

Advantage #3: Proven inflation hedge

Our inflation analysis shows that over the last 40+ years, Canadian Private Apartments have normally provided positive annual returns during periods in which inflation (as measured by the annual change in the Consumer Price Index) was over 4%.

While the relationship between real estate and inflation should not be the primary factor for investment in real estate, it is a component worth considering within the context of the benefits of diversification to a multi-asset portfolio.

Advantage #4: More tax efficient

Although dividends received from common/preferred shares are relatively more tax efficient than interest income, both may be significantly less tax efficient than distributions received from a Private Real Estate Investment Trust (REIT).

Compare the tax consequences of investing $100,000 for five years in a common/preferred share with a 6% dividend, an interest paying security yielding 6%, and an investment in a Private REIT with a 6% distribution.

Higher after-tax cash flow: Although all three investments would provide the investor with $6,000 in pre-tax annual cash flows, the dividends received and the interest income earned at a 45% tax rate would be subject to $1,712 and $2,700 in taxes each year, respectively.

By contrast, the private REIT investor may not be required to pay any taxes in the current year and may be able to defer paying any tax until the investment is sold.

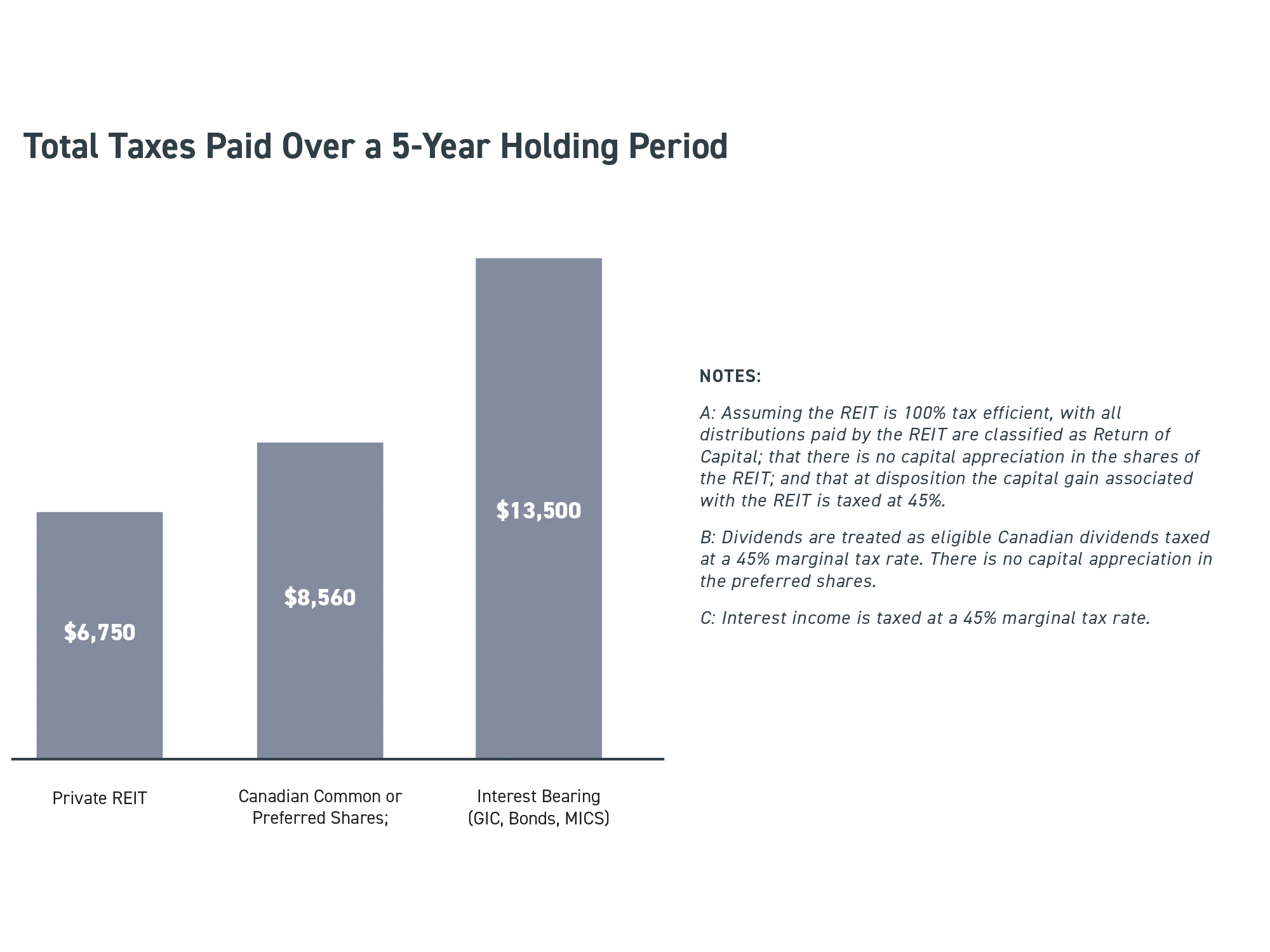

Pay less total taxes

Total taxes paid over five years on the dividend and interest income would be $8,560 and $13,500, respectively. On the private REIT, taxes would only be $6,750, and could potentially be deferred until the investment is sold.

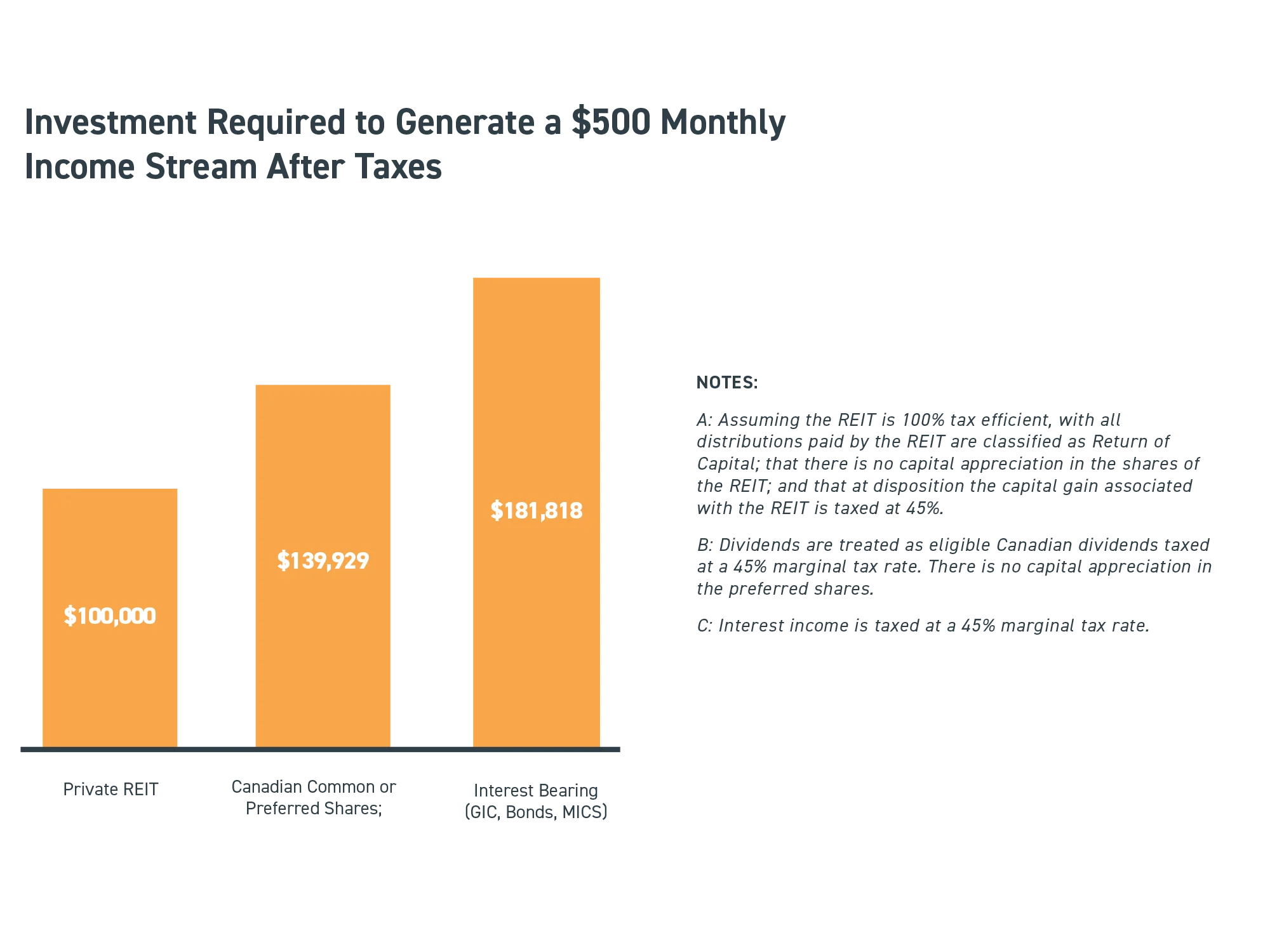

Tie up less capital

From an after-tax perspective, an investor would have to invest over $181,818 in a 6% interest bearing security, or $139,929 in a 6% preferred/common share, to generate the same $500 a month after-tax income stream as an investor who had invested $100,000 in a private REIT with a 6% yield. By using a private REIT to generate your required cash flow, you could free up a substantial amount of capital to be invested elsewhere, thereby potentially increasing the overall returns of your portfolio.

SOURCES

- Private Canadian Apartments = MSCI/REALPAC Canada Quarterly Property Fund Index- Residential / MSCI Real Estate Analytics Portal – Accessed January 20, 2025

- Canadian Commercial Real Estate = MSCI/REALPAC Canada Quarterly Property Fund Index – All Properties / MSCI Real Estate Analytics Portal – Accessed January 20, 2025

- Canadian Bonds = FTSE Canadian Universe Bond Index /www.blackrock.com/ca – Accessed January 20, 2025

- Canadian Equities = S&P/TSX Composite Total Return Index / Bloomberg – Accessed January 20, 2025

- U.S. Equities = MSCI US Index / Bloomberg – Accessed January 20, 2025

- Global Equities = MSCI World Index / MSCI Inc. – Accessed January 20, 2025

- Emerging Market Equities = MSCI Emerging Market Index / MSCI Inc. – Accessed January 20, 2025

- Annual Inflation – Statistics Canada series id=V41690973 – Accessed January 20, 2025

- Traditional investments = Canadian Bonds3 , Canadian Equities4 , US Equities5 , Global Equities6 and Emerging Market Equities7 – Accessed January 20, 2025