Alternative Investments: Why Private Real Estate Funds Stand Out in Modern Portfolios

Table of Contents

Alternative Investments

Some investors are realizing that traditional methods of mitigating risk such as spreading holdings across more geographic regions or sectors or balancing their portfolios between equities and fixed income may not have the level of diversification they want.

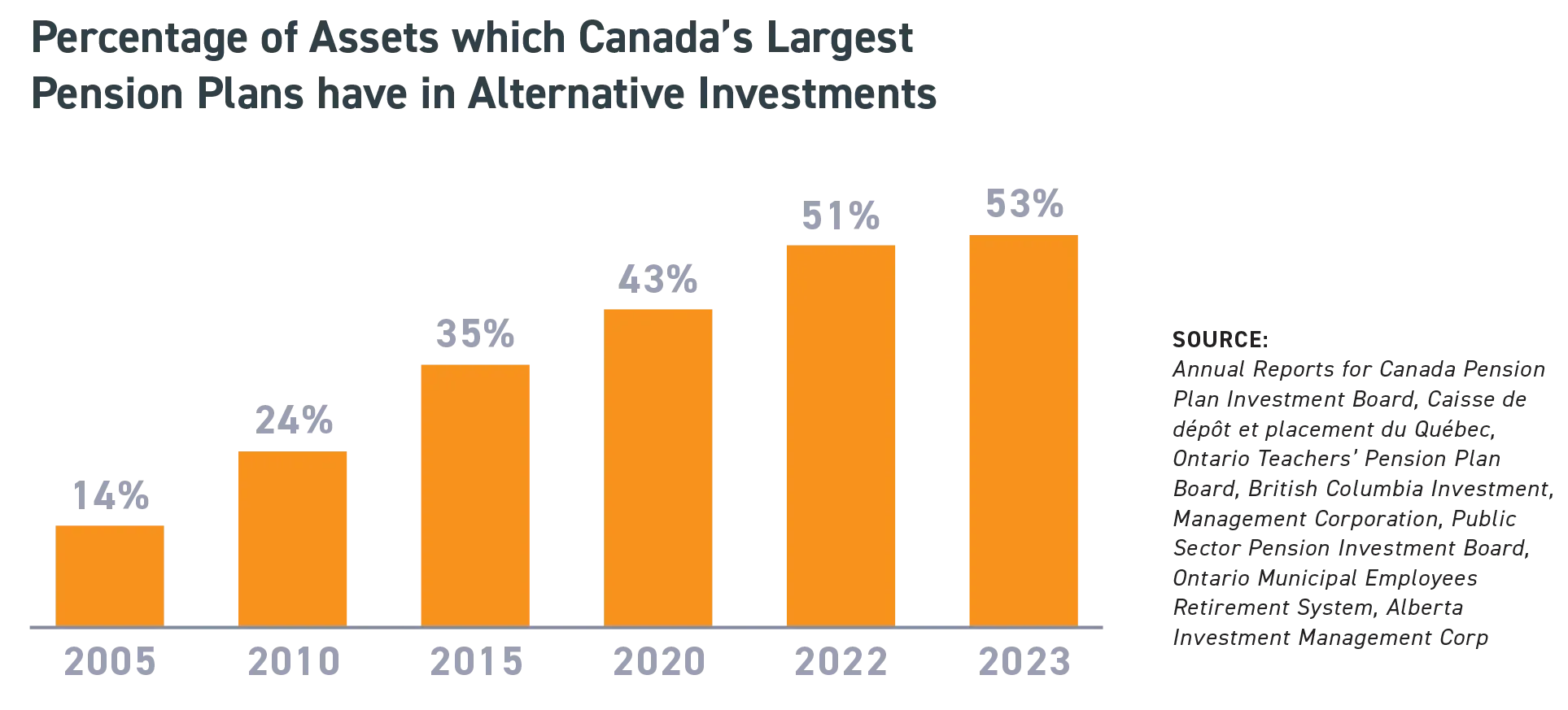

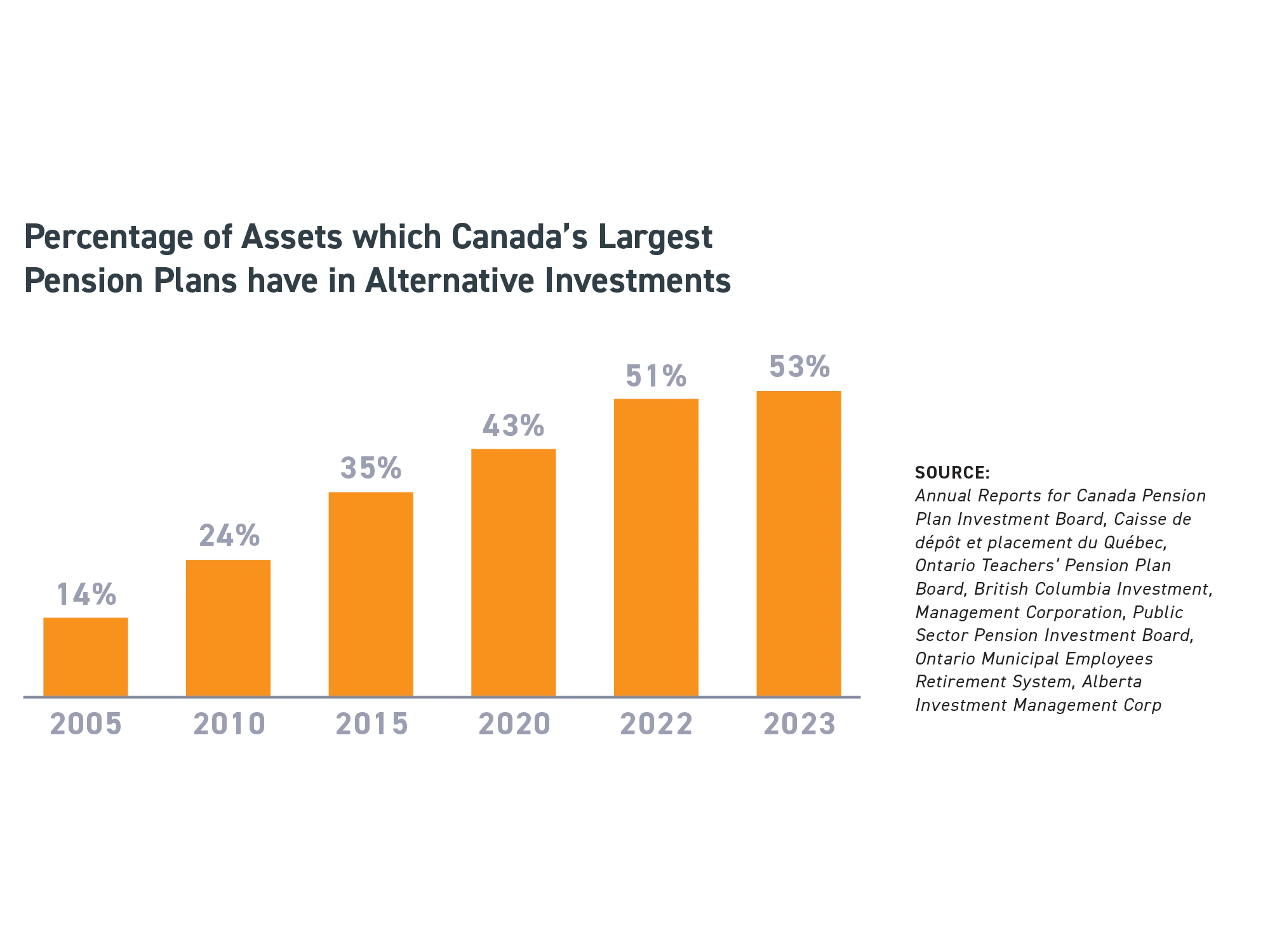

They could benefit from following the “smart money” — that is, large, well-capitalized, and often conservative investment institutions such as pension funds. Over the past several decades, Canada’s top eight pension funds, the “Maple Eight” have become the model of global pension funds looking to improve performance and avoid funding shortfalls.

Working toward this objective, the Maple Eight began to diversify into alternative investments — financial assets that don’t fit into conventional investment categories — in the 1990s and have continued that trend over time. Alternative investments can include private equity or venture capital, hedge funds, commodities, and private real estate funds.

Related

Tellingly, over the last 20 years, North America’s CPP, OMERS, OTPP, CalPERS, Yale Endowment, and Harvard Endowment have all substantially increased their relative holdings in real estate and other alternative investments to reduce the overall volatility and increase the returns of their investment portfolios. Omitting the holdings of Healthcare of Ontario Pension Plan (the smallest of the Maple Eight), Canada’s seven largest pension plans dramatically increased the share of alternative assets within the C$1.7T they manage.

Why more investors are building diversified portfolios with alternative investments

Like the market’s biggest players, everyday investors are increasingly open to the important role that alternative investments can play as part of a modern investment portfolio.

The traditional 60/40 portfolio was designed to balance growth and stability — when stocks declined, bonds typically helped cushion the impact. The limitations of this approach were made clear in 2022, when surging interest rates saw both stock and bond markets take heavy losses at the same time.

Following these events, alternative investments like private real estate funds are increasingly cast as an important piece of a well-diversified portfolio. Modern investors often consider a 10 to 20% allocation to alternative investments to diversify their holdings beyond stocks and bonds and potentially enhance returns.

Private real estate funds have delivered positive historical results

Private real estate funds tend to focus on specific property types, offering investors tailored exposure to a variety of assets. Private rental apartment funds focused on residential income-producing properties have long been a popular choice, and for good reason.

In addition to diversification, private rental apartment funds typically aim to provide investors with regular income and capital appreciation opportunities. With these benefits, investors should be aware that private alternative investments come with liquidity-, transparency-, and management-related risks.

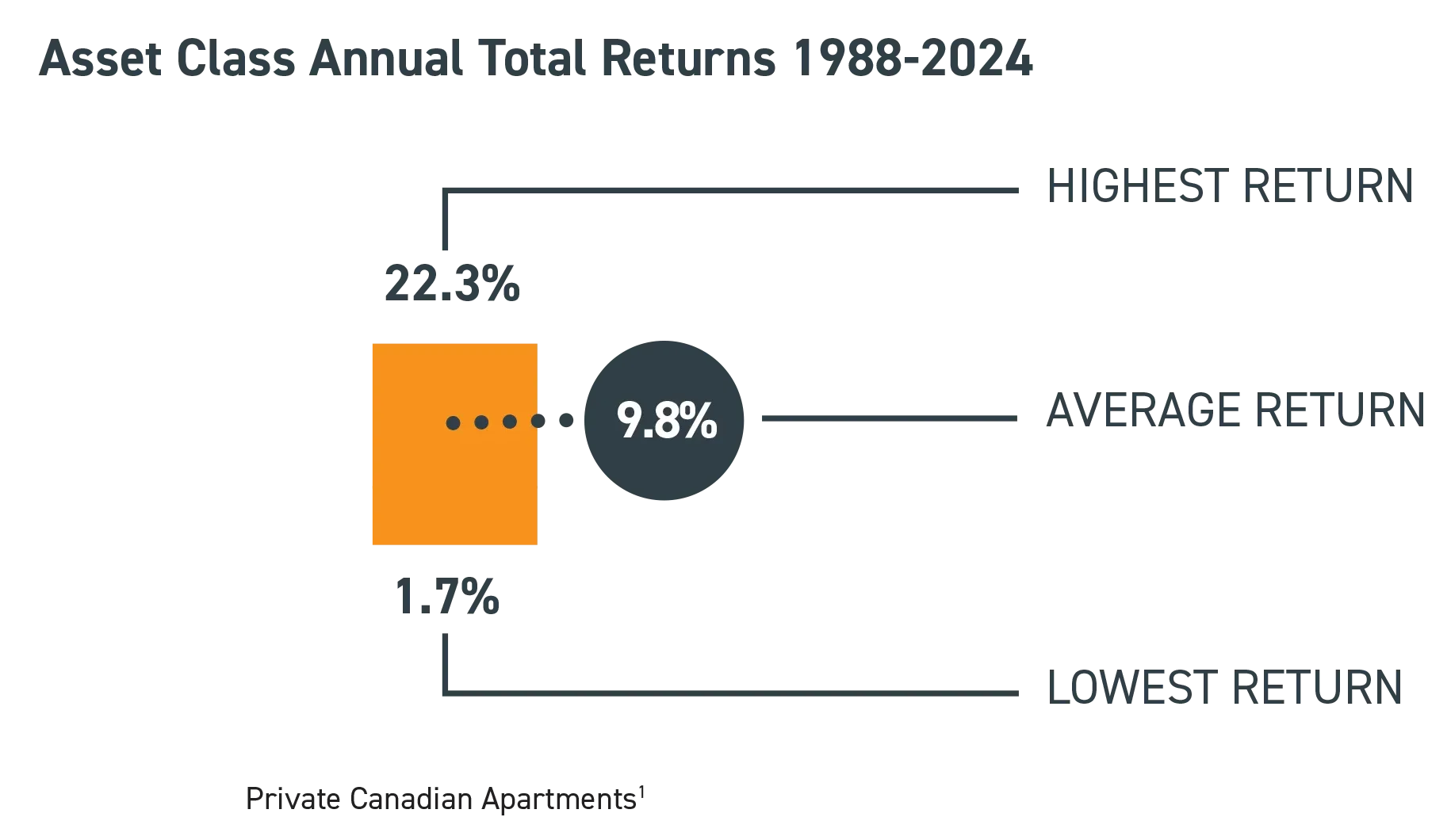

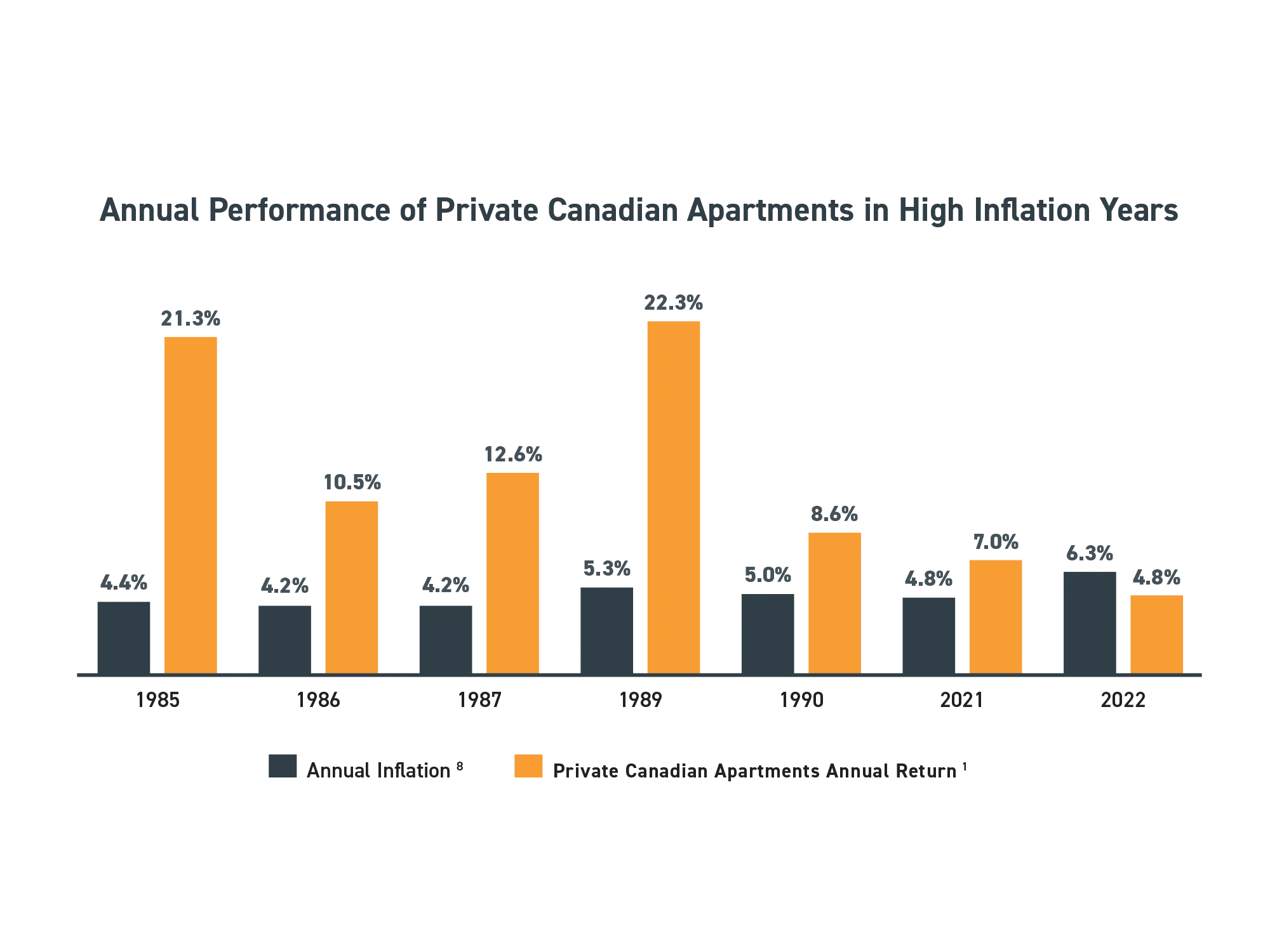

The historical performance of private rental apartment funds can be better understood by looking at the Private Canadian Apartments Index, which includes transactions and development activity by private and institutional real estate owners in Canada. This index, formally known as the MSCI/REALPAC Canada Quarterly Property Fund Index – Residential, is produced by Morgan Stanley Capital International (MSCI) and is not publicly available.

Related

As illustrated above, the Private Canadian Apartments Index has yet to record a year without positive returns since its creation in 1985. Although this measure does not guarantee future performance, it helps demonstrate the resilience of the index’s underlying asset class across various market cycles, including the Financial Crisis of 2008-2009 and the COVID-19/Inflation Crisis.

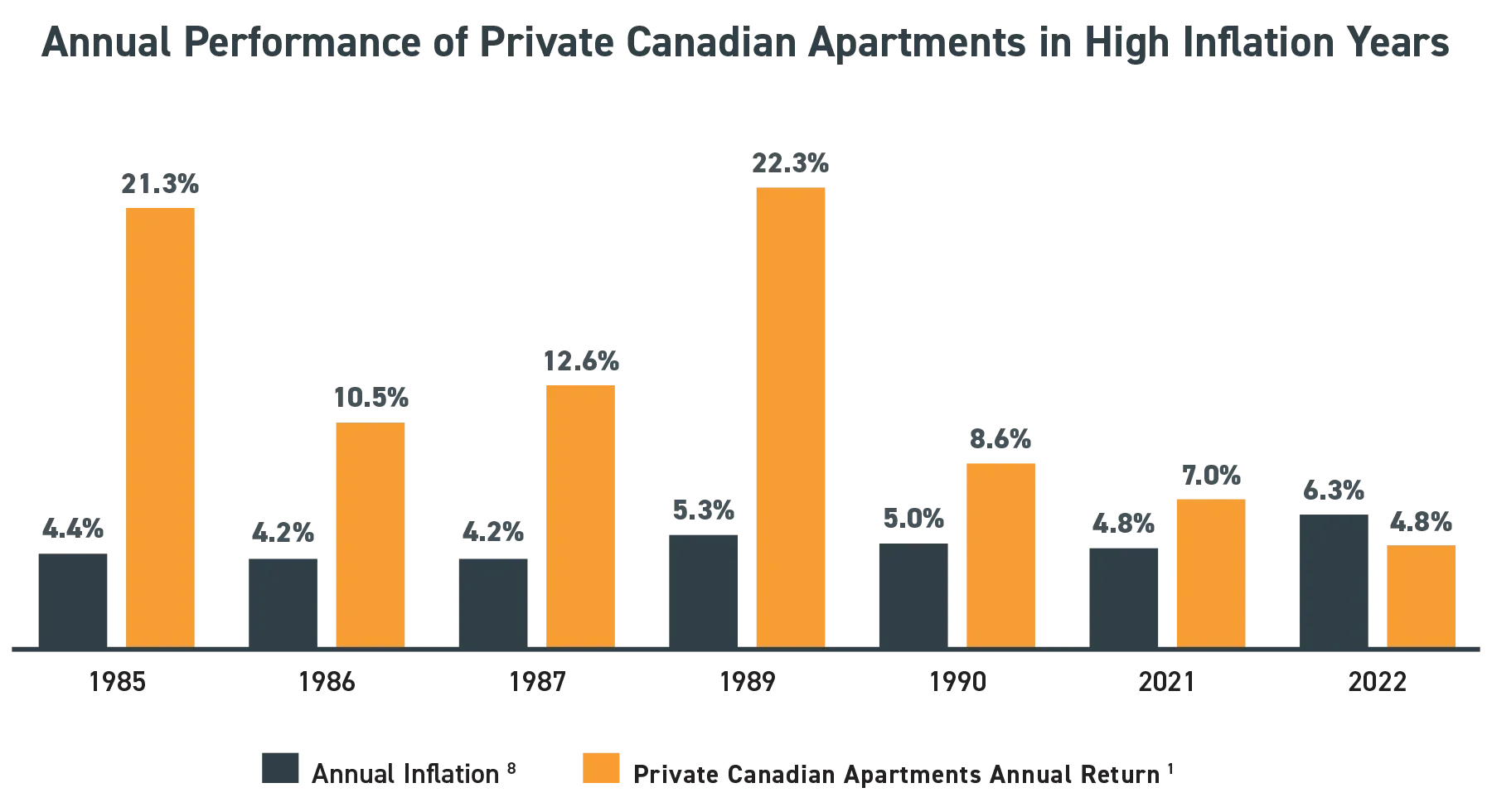

Like during those periods, the potential impact of inflation remains top of mind for many investors. With few exceptions, the Private Canadian Apartments Index delivered inflation-beating annual returns in years where inflation (as measured by the annual change in the Consumer Price Index, or CPI) exceeded 4%.

1) Statistics Canada, Consumer Price Index, annual, not seasonally adjusted. Table: 18-10-0005-01. Accessed October 8, 2025.

2) Private Canadian Apartments Index = MSCI/REALPAC Canada Quarterly Property Fund Index- Residential / MSCI Real Estate Analytics Portal – Accessed October 8, 2025

This includes the challenging period from 1986 to 1991 when the index delivered between 8.6% and 22.3%, significantly outpacing inflation.

Private rental apartment funds can be tax-efficient investments

Distributions received from a rental apartment fund can be more tax efficient than other forms of income in a non-registered account, creating opportunities for long-term tax planning and smart wealth generation. Of course, an individual investor’s choice of investment will depend on many factors, including their risk comfort level and investment objectives. Different investment assets are characterized by varying levels of risks and returns. Tax efficiency is one criterion we can examine.

To explore the tax efficiency of some popular sources of investment income, compare the tax treatment of $100,000 allocated to an investment yielding a 6% dividend, an interest-paying investment yielding 6%, or a rental apartment fund with a 6% distribution.

How investment income is taxed

| Eligible Dividends | Interest Income | Private Rental Apartment Fund Distributions |

|---|---|---|

|

|

|

*15.0198% of grossed-up taxable dividend

** 10% (Ontario) of grossed-up taxable dividend

An investor in a rental apartment fund with a 6% distribution may be able to defer paying any tax until the investment is sold, assuming the fund is 100% tax efficient and classifies all its distributions as return of capital (ROC). ROC occurs when a rental apartment fund distributes amounts sourced from an investor’s original investment, rather than from income or profits.

From an after-tax cash flow perspective, the dividend-paying investment would generate $362 every month while the interest-bearing investment would generate $275. The investor in the rental apartment fund would receive $387.50 monthly if the distributions were fully taxed that year or a full $500 if distributions were classified as 100% ROC.

In this way, an investor who chooses tax-efficient investments in private rental apartment funds to generate cash flow can potentially free up a substantial amount of capital, which can be deployed elsewhere or reinvested to accelerate the effects of compounding.

Although all three investments would provide the investor with $6,000 in pre-tax annual cash flows, any dividends and interest earned would be subject to taxes in the year earned. Assuming 45%, that could mean a tax burden of $1,655 and $2,700 each year, respectively.

Why private rental apartments are built for long-term investors

When considering their consistent historical performance, growth potential, and tax efficiency benefits, private rental apartments stand out as compelling long-term alternative investments. For investors with medium- to long-term horizons, the extended timeframe helps lessen the impact of illiquidity while allowing the benefits of diversification to emerge over time.

†Not to be construed as tax advice. For specific tax advice, consult a tax professional.

Share This Story!

Some investors are realizing that traditional methods of mitigating risk such as spreading holdings across more geographic regions or sectors or balancing their portfolios between equities and fixed income may not have the level of diversification they want.

They could benefit from following the “smart money” — that is, large, well-capitalized, and often conservative investment institutions such as pension funds. Over the past several decades, Canada’s top eight pension funds, the “Maple Eight” have become the model of global pension funds looking to improve performance and avoid funding shortfalls.

Working toward this objective, the Maple Eight began to diversify into alternative investments — financial assets that don’t fit into conventional investment categories — in the 1990s and have continued that trend over time. Alternative investments can include private equity or venture capital, hedge funds, commodities, and private real estate funds.

Tellingly, over the last 20 years, North America’s CPP, OMERS, OTPP, CalPERS, Yale Endowment, and Harvard Endowment have all substantially increased their relative holdings in real estate and other alternative investments to reduce the overall volatility and increase the returns of their investment portfolios. Omitting the holdings of Healthcare of Ontario Pension Plan (the smallest of the Maple Eight), Canada’s seven largest pension plans dramatically increased the share of alternative assets within the C$1.7T they manage.

Why more investors are building diversified portfolios with alternative investments

Like the market’s biggest players, everyday investors are increasingly open to the important role that alternative investments can play as part of a modern investment portfolio.

The traditional 60/40 portfolio was designed to balance growth and stability — when stocks declined, bonds typically helped cushion the impact. The limitations of this approach were made clear in 2022, when surging interest rates saw both stock and bond markets take heavy losses at the same time.

Following these events, alternative investments like private real estate funds are increasingly cast as an important piece of a well-diversified portfolio. Modern investors often consider a 10 to 20% allocation to alternative investments to diversify their holdings beyond stocks and bonds and potentially enhance returns.

Private real estate funds have delivered positive historical results

Private real estate funds tend to focus on specific property types, offering investors tailored exposure to a variety of assets. Private rental apartment funds focused on residential income-producing properties have long been a popular choice, and for good reason.

In addition to diversification, private rental apartment funds typically aim to provide investors with regular income and capital appreciation opportunities. With these benefits, investors should be aware that private alternative investments come with liquidity-, transparency-, and management-related risks.

The historical performance of private rental apartment funds can be better understood by looking at the Private Canadian Apartments Index, which includes transactions and development activity by private and institutional real estate owners in Canada. This index, formally known as the MSCI/REALPAC Canada Quarterly Property Fund Index – Residential, is produced by Morgan Stanley Capital International (MSCI) and is not publicly available.

As illustrated above, the Private Canadian Apartments Index has yet to record a year without positive returns since its creation in 1985. Although this measure does not guarantee future performance, it helps demonstrate the resilience of the index’s underlying asset class across various market cycles, including the Financial Crisis of 2008-2009 and the COVID-19/Inflation Crisis.

Like during those periods, the potential impact of inflation remains top of mind for many investors. With few exceptions, the Private Canadian Apartments Index delivered inflation-beating annual returns in years where inflation (as measured by the annual change in the Consumer Price Index, or CPI) exceeded 4%.

1) Statistics Canada, Consumer Price Index, annual, not seasonally adjusted. Table: 18-10-0005-01. Accessed October 8, 2025.

2) Private Canadian Apartments Index = MSCI/REALPAC Canada Quarterly Property Fund Index- Residential / MSCI Real Estate Analytics Portal – Accessed October 8, 2025

This includes the challenging period from 1986 to 1991 when the index delivered between 8.6% and 22.3%, significantly outpacing inflation.

Private rental apartment funds can be tax-efficient investments

Distributions received from a rental apartment fund can be more tax efficient than other forms of income in a non-registered account, creating opportunities for long-term tax planning and smart wealth generation. Of course, an individual investor’s choice of investment will depend on many factors, including their risk comfort level and investment objectives. Different investment assets are characterized by varying levels of risks and returns. Tax efficiency is one criterion we can examine.

To explore the tax efficiency of some popular sources of investment income, compare the tax treatment of $100,000 allocated to an investment yielding a 6% dividend, an interest-paying investment yielding 6%, or a rental apartment fund with a 6% distribution.

How investment income is taxed

| Eligible Dividends | Interest Income | Private Rental Apartment Fund Distributions |

|---|---|---|

|

|

|

*15.0198% of grossed-up taxable dividend

** 10% (Ontario) of grossed-up taxable dividend

Although all three investments would provide the investor with $6,000 in pre-tax annual cash flows, any dividends and interest earned would be subject to taxes in the year earned. Assuming 45%, that could mean a tax burden of $1,655 and $2,700 each year, respectively.

An investor in a rental apartment fund with a 6% distribution may be able to defer paying any tax until the investment is sold, assuming the fund is 100% tax efficient and classifies all its distributions as return of capital (ROC). ROC occurs when a rental apartment fund distributes amounts sourced from an investor’s original investment, rather than from income or profits.

From an after-tax cash flow perspective, the dividend-paying investment would generate $362 every month while the interest-bearing investment would generate $275. The investor in the rental apartment fund would receive $387.50 monthly if the distributions were fully taxed that year or a full $500 if distributions were classified as 100% ROC.

In this way, an investor who chooses tax-efficient investments in private rental apartment funds to generate cash flow can potentially free up a substantial amount of capital, which can be deployed elsewhere or reinvested to accelerate the effects of compounding.

Why private rental apartments are built for long-term investors

When considering their consistent historical performance, growth potential, and tax efficiency benefits, private rental apartments stand out as compelling long-term alternative investments. For investors with medium- to long-term horizons, the extended timeframe helps lessen the impact of illiquidity while allowing the benefits of diversification to emerge over time.

*Not to be construed as tax advice. For specific tax advice, consult a tax professional.