A New Condo Cycle Is Here: Why Some Developers Are Already Pulling Ahead

In recent years, Canadian condominium apartment developers have demonstrated impressive resilience, overcoming significant financial and planning-related challenges. Despite the pressures of high interest rates, elevated construction costs, and lengthy approval processes, they remained steadfast, continuing to focus on what they do best: building and selling new homes.

While some of the above challenges are beginning to ease as interest rates trend downward, developers facing economic pressures and geopolitical uncertainty — an evolving trade war — remain focused on sustaining operations today, with an eye toward a market shift (expected by year-end) and a new market cycle defined by a projected shortage of new condos emerging in the years to follow.

The industry will see the sector continue to shed less-prepared firms unable to adapt to the industry’s new structural realities and challenges. Experienced, well-capitalized, and agile developers will have the highest chances of successfully evolving their practices to navigate this new economic environment.

But what will it take to thrive — not just survive — in the unfolding market? Several practices can distinguish high-performing developers from those facing greater challenges.

Strengthening and exploring financing models

As we’ve discussed before, small- and medium-sized developers with limited financial resources have had less success in absorbing the impacts of higher interest rates and the subsequent market downturn. By contrast, established firms with large cash reserves and strategic banking relationships have enjoyed significantly more opportunities to maintain their growth trajectories. Even as economic conditions improve, benefiting the broader sector, the spotlight will remain on development companies with a history of prudent financial and governance practices as investors seek to improve the stability of their portfolios and manage future downturns.

Of course, this is also an opportunity to strengthen existing practices. The traditional Canadian developer model often relies on a high-risk, high-leverage approach, where one project funds the next. Many developers have operated with low equity and high debt, betting on continuous sales and rising prices to sustain their business. This model has unravelled in recent times — developers left holding land with heavy debt burdens face mounting interest costs without revenue, leaving them vulnerable.

In contrast, conservative developers have taken a more sustainable approach by maintaining financial discipline. Well-managed debt portfolios, project-specific financing, and minimal land debt and are some hallmarks of sustainable businesses who are equipped to navigate the coming years. These practices bolster developers’ ability to weather all types of markets. In the near term, companies requiring more flexibility can reduce reliance on traditional debt models by exploring joint ventures and equity partnerships to get projects off the ground and mitigate banking risks.

Right-sizing projects to reduce risk and meet demand

Developing high-rise buildings or master-planned communities can be a massive undertaking in stable times, let alone today’s environment. Recent years experienced fluctuating construction costs leading to financing difficulties, putting a pause on several high-profile, large-scale projects. Agile developers are shifting their focus to smaller-scale infill projects like mid-rises.

Mid-rise development requires less up-front capital, reducing some financial hurdles. However, its primary advantages stem from its relatively shorter timelines. From planning, to construction, to completion, mid-rises can tie up capital for less time and reward investors sooner than high-rises. Faster completion times also help mitigate interest rate and cost fluctuations. These inherent advantages have encouraged municipalities like Toronto to significantly streamline mid-rise development to address ongoing housing shortages.

Exterior build form is only part of the equation. As buyer interest in small, lesser-quality condominium apartments declines in major markets, some developers are shifting their focus toward building larger, high-quality units. This shift reflects the growing influence of end users, who are increasingly replacing speculators as the dominant players in markets like Toronto and Vancouver. Unlike speculators, end users and long-term investors prioritize generous layouts, quality finishes, convenient amenities, and prime locations — making these features critical for successful project capitalization.

Fostering public-private collaboration to ease challenges

Despite a challenging environment, forward-thinking developers are not sitting idle. Some developers are actively sitting down with policymakers, shaping public discourse, and discussing solutions to help reduce obstacles to construction, including onerous red tape, zoning constraints, and costly regulations. After gaining momentum last year, these efforts have already dismantled decades of policy constraints in some jurisdictions, winning as-of-right municipal zoning for denser housing and federal tax incentives.

As well, Canadians have seen the introduction of policies aimed at stimulating new home purchases and, by extension, the developers who build them. These include the recent removal of the GST for first-time homebuyers purchasing homes priced under $1M, expanding 30-year insured mortgages to first and newly built homes, and the increase of the insured mortgage price cap from $1M to $1.5M. Momentum on the housing affordability file can be expected to further increase project feasibility and overall market sentiment.

In 2025, forging stronger ties with government organizations at all levels will help to effect necessary change and remove barriers to creating more housing. The Canadian Chamber of Commerce Housing and Development Council, Canada Mortgage and Housing Corporation, and other advocacy bodies are continuing the conversation. Public-private partnerships can also be taken more literally, as some developers seek to partner with governments on affordable and rental housing creation to reduce market risks.

Development outlook: A condo shortage is taking shape

Market fundamentals are showing signs of improvement this year. Pent-up demand is expected to translate into increased homebuying activity as shrinking borrowing costs create more favourable buying conditions. According to the Canadian Real Estate Association, this could support a rebound in sales across Canada in 2025 — a critical factor in driving new condo starts.

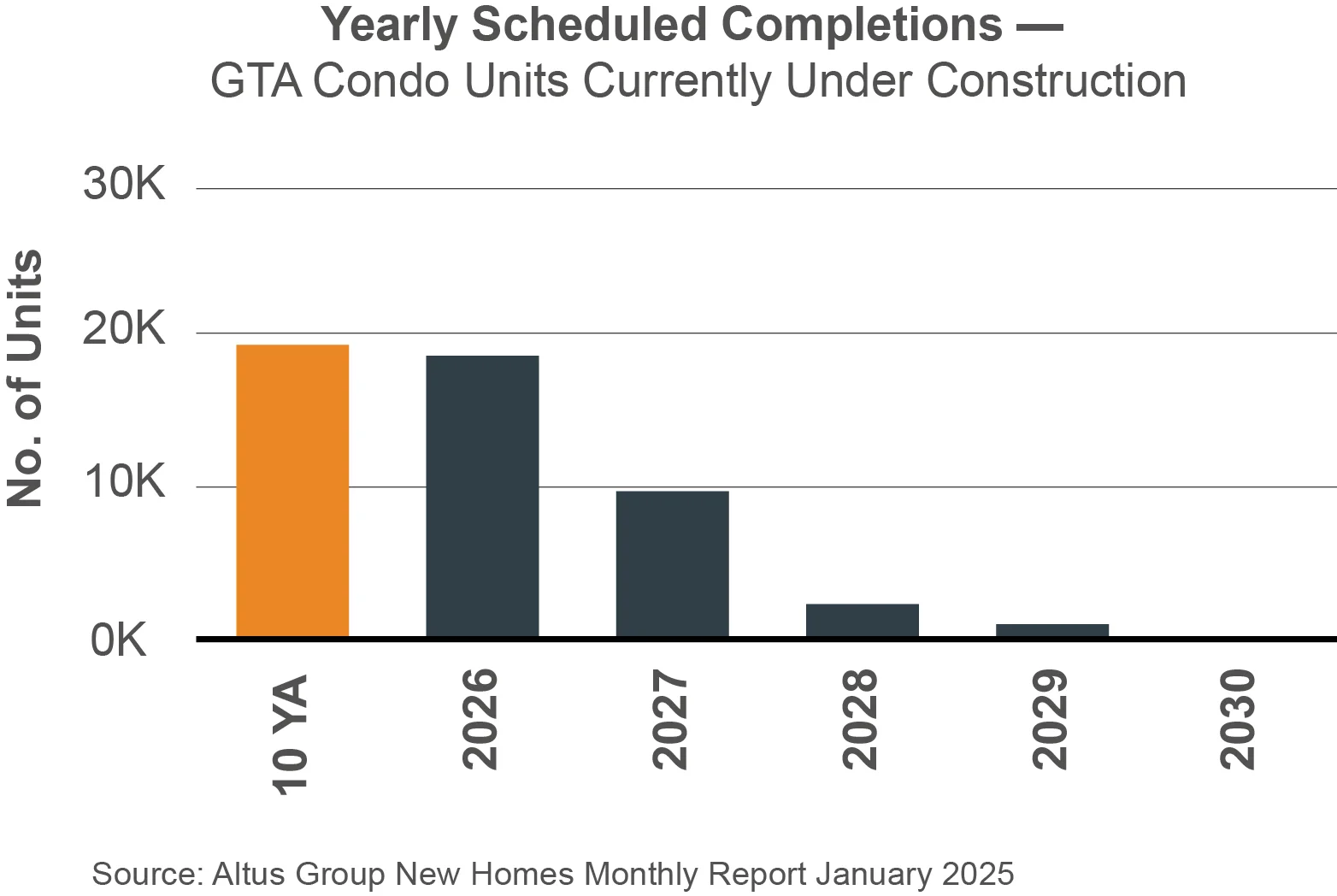

That said, investors involved in condo development must look beyond 2025. New condominium starts in the GTHA are expected to remain constrained throughout 2025, after 2024 starts fell to their lowest level since 2002 and well below the 10-year average. In its latest Condo Market Survey, Urbanation forecasts a massive decrease in new supply beginning in 2026–2027. Completions are expected to fall off a cliff after 2025, with Altus Group’s latest new homes survey revealing a historic decline in condo supply taking shape. Meanwhile, Ontario saw a 38.4% decline in building permits between 2022 and 2023, and zoning applications dropped more than 30%, indicating a deepening slowdown in new development activity.

This looming shortage will collide with demand pressures from population growth and a potential resurgence in homebuyer activity, driven by improved borrowing rates and new government incentives. For developers, this creates a rare window of opportunity: projects that commence now are expected to deliver just as supply bottoms out and demand pressures intensify. With limited new product coming to market, these developments will benefit from strong pricing power, faster absorption rates, and heightened investor interest — conditions that can support improved developer margins. In a market likely defined by future scarcity, well-timed condos will command a premium.

Much can change in the year ahead. Development companies that stay disciplined and forward-thinking will be best positioned to capitalize on the new condo cycle.