5 Passive Income Streams for Early Retirement in Canada

Table of Contents

Passive Income Streams for Early Retirement in Canada

Imagine this: You’ve been diligently saving and investing for retirement, picturing a comfortable future where you can finally relax and enjoy life. But as time passes, the rising cost of everyday essentials — groceries, housing, utilities, and health care — slowly erodes your purchasing power. Exploring passive income strategies can help you preserve more of your hard-earned nest egg and free up time for enjoyment.

The reality is that in today’s economy, passive income isn’t just a bonus — it’s a financial lifeline. Whether you’re focused on retirement, growing your wealth over time, or simply want your money to work harder for you, passive income offers a practical and accessible way to do just that. In short, it lets you earn without constantly trading your time for dollars or selling off your portfolio.

Why passive income is essential for early retirement

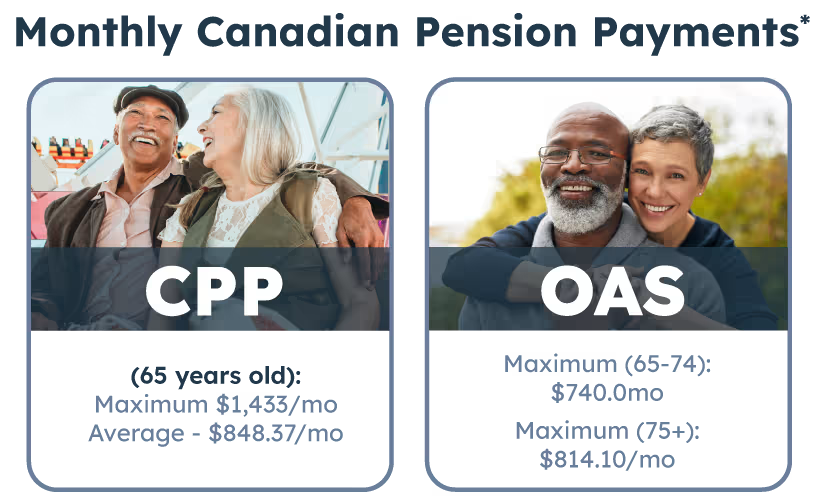

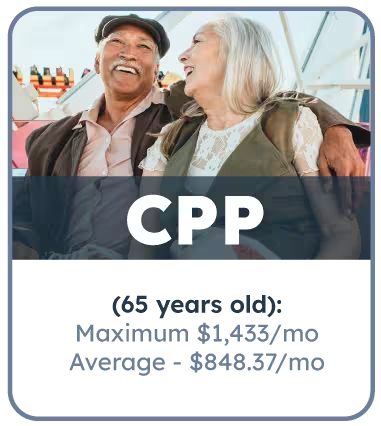

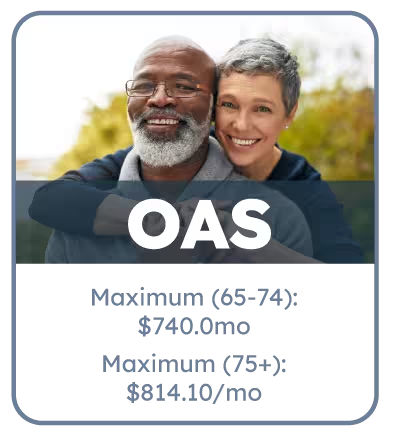

When it comes to securing a steady income during retirement, diversifying your income streams can play an especially important role. While the government-backed Canada Pension Plan (CPP) and Old Age Security (OAS) programs are two popular sources of income, Canadians only become eligible to draw CPP starting at 60, and OAS benefits do not begin until 65 (with the option to defer until 70).

That means anyone planning to retire early — say, at 55 — will need investments that can help bridge the income gap between leaving work and becoming eligible for pension income. Furthermore, accessing certain benefits as soon as they become available can reduce your regular payouts.

*January 2025

This is one reason many Canadians choose to build their income sources beyond government pensions. Several sources together can help diversify your income, particularly since pension payments, though steady and guaranteed, may fall below the expenses required to comfortably enjoy your golden years. And with Canadians living longer than ever, many retirees want to avoid starting their retirement by cashing out investments or selling stocks, keeping capital intact for as long as possible.

Enter passive income strategies. These income streams can range from interest-bearing investments to property ownership, empowering you to make the most of retirement by minimizing personal management.

The best part? You can start building these streams today and potentially grow your investment well before you retire — whether that’s next year or decades from now.

Here are five ways Canadian investors are earning passive income in early retirement, including one strategy many don’t yet know about: investing in real estate without managing physical property.

Popular Investments for Passive Income.

Passive Income Streams for Early Retirement in Canada

Imagine this: You’ve been diligently saving and investing for retirement, picturing a comfortable future where you can finally relax and enjoy life. But as time passes, the rising cost of everyday essentials — groceries, housing, utilities, and health care — slowly erodes your purchasing power. Exploring passive income strategies can help you preserve more of your hard-earned nest egg and free up time for enjoyment.

The reality is that in today’s economy, passive income isn’t just a bonus — it’s a financial lifeline. Whether you’re focused on retirement, growing your wealth over time, or simply want your money to work harder for you, passive income offers a practical and accessible way to do just that. In short, it lets you earn without constantly trading your time for dollars or selling off your portfolio.

Why passive income is essential for early retirement

When it comes to securing a steady income during retirement, diversifying your income streams can play an especially important role. While the government-backed Canada Pension Plan (CPP) and Old Age Security (OAS) programs are two popular sources of income, Canadians only become eligible to draw CPP starting at 60, and OAS benefits do not begin until 65 (with the option to defer until 70).

That means anyone planning to retire early — say, at 55 — will need investments that can help bridge the income gap between leaving work and becoming eligible for pension income. Furthermore, accessing certain benefits as soon as they become available can reduce your regular payouts.

Monthly Canadian Pension Payments*

*January 2025

This is one reason many Canadians choose to build their income sources beyond government pensions. Several sources together can help diversify your income, particularly since pension payments, though steady and guaranteed, may fall below the expenses required to comfortably enjoy your golden years. And with Canadians living longer than ever, many retirees want to avoid starting their retirement by cashing out investments or selling stocks, keeping capital intact for as long as possible.

Enter passive income strategies. These income streams can range from interest-bearing investments to property ownership, empowering you to make the most of retirement by minimizing personal management.

The best part? You can start building these streams today and potentially grow your investment well before you retire — whether that’s next year or decades from now.

Here are five ways Canadian investors are earning passive income in early retirement, including one strategy many don’t yet know about: investing in real estate without managing physical property.

Popular Investments for Passive Income.

Dividend stocks

Dividend-paying stocks and ETFs are a go-to passive income source for many Canadian retirees, especially those who prefer investments that can provide regular cash flow. Sectors like banks, telecom, and utilities are often favoured for their history of steady dividend payments and long-term resilience. Holding these investments in a Tax-Free Savings Account (TFSA) or Registered Retirement Plan (RRSP) can also offer added advantages, such as tax-free income or the tax-deferred growth of your initial investment. (More on that later!)

At the same time, dividend income isn’t entirely hands-off. As many investors may have noticed recently, dynamic market conditions can cause fluctuations in dividend payments and stock values, leading to less predictable cash flows. That can mean more stress for retirees and other income-seeking investors.

Nothing on this website is investment, financial, legal, tax, or accounting advice. You should consult your own professional advisors and an appropriately registered dealer in your jurisdiction before making any investment decision.

Dividend stocks

Dividend-paying stocks and ETFs are a go-to passive income source for many Canadian retirees, especially those who prefer investments that can provide regular cash flow. Sectors like banks, telecom, and utilities are often favoured for their history of steady dividend payments and long-term resilience. Holding these investments in a Tax-Free Savings Account (TFSA) or Registered Retirement Plan (RRSP) can also offer added advantages, such as tax-free income or the tax-deferred growth of your initial investment. (More on that later!)

At the same time, dividend income isn’t entirely hands-off. As many investors may have noticed recently, dynamic market conditions can cause fluctuations in dividend payments and stock values, leading to less predictable cash flows. That can mean more stress for retirees and other income-seeking investors.

Nothing on this website is investment, financial, legal, tax, or accounting advice. You should consult your own professional advisors and an appropriately registered dealer in your jurisdiction before making any investment decision.

Retirement Planning Made Easy With Private

Real Estate Investments

Retirement Planning Made Easy With Private

Real Estate Investments

Dividend stocks for early retirement income

Some of the more reliable dividend-paying stocks may yield about 3-4% annually, which translates to roughly $1,250-$1,665 each month on a $500,000 investment, provided market conditions remain stable. If conditions shift, this amount may change, or the dividend discontinued altogether. Housing eligible dividend stocks in a registered account can help you keep more of the dividends you earn.

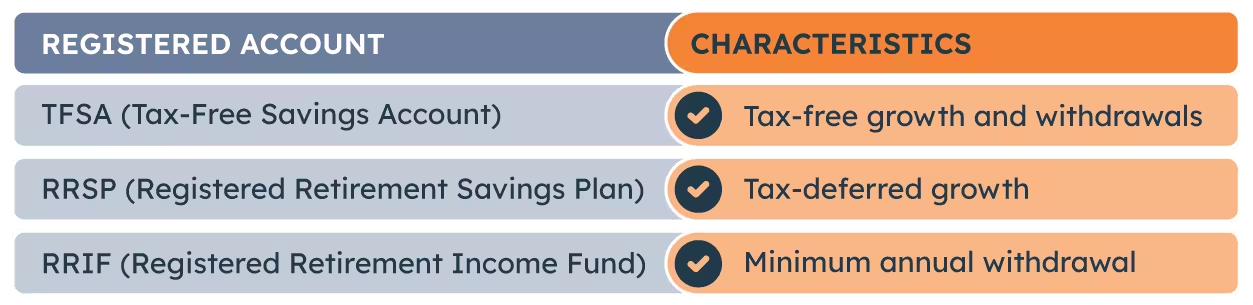

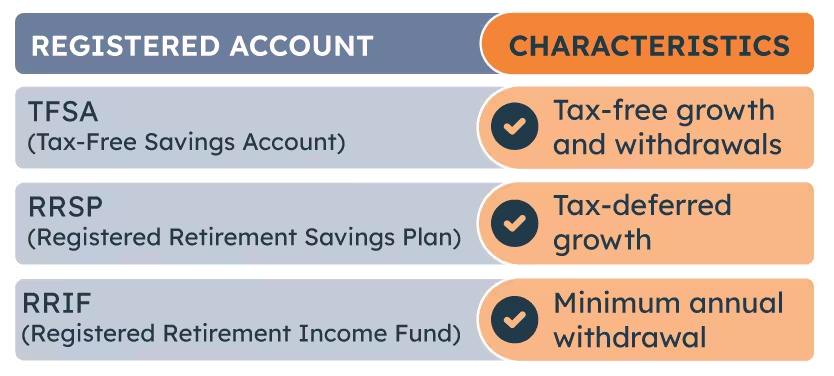

As its name suggests, investments grow tax-free within a TFSA. Earned dividend income is not taxable — a meaningful advantage in retirement when you rely on making regular withdrawals. Dividends held in an RRSP — which becomes a Registered Retirement Income Fund (RRIF) upon retirement — grow tax deferred and are considered income for tax purposes when withdrawn. However, contributions made while you’re still working reduce your taxable income in the same year, offering immediate benefits.

Non-registered accounts can also offer some advantages. For example, the Canadian Dividend Tax Credit reduces the tax burden on eligible dividends. With careful tax planning and active portfolio management, dividend-paying stocks can play an important role in diversifying an early retiree’s income portfolio.

Registered Accounts

Fixed-income investments

Simple and safe, many early retirees rely on fixed-income investments like Guaranteed Investment Certificates (GICs) or bonds to generate regular cash flow through earned interest, with the added benefit of helping to preserve their initial investment.

While widely considered a prudent investment vehicle for risk-averse investors, the returns and cash flow from fixed-income products can be modest, in line with their lower risk profile. In some years, your purchasing power may even decline — despite your investment technically growing on paper.

For example, Government of Canada bonds set the benchmark for the so-called “risk-free rate” that other investments are compared against, but currently yield only about 2.76% on a five-year coupon at a time when inflation hovers around 2%.

Fixed-income investments for early retirement

Fixed-income products like GICs and bonds fit naturally into registered accounts. In a TFSA, interest earned is completely tax-free, allowing retirees to withdraw income without increasing their taxable income for the year. In an RRSP — and later a RRIF — interest grows tax-deferred, though withdrawals are fully taxed as income, making careful planning important when converting to retirement income.

Dividend stocks for early retirement income

Some of the more reliable dividend-paying stocks may yield about 3-4% annually, which translates to roughly $1,250-$1,665 each month on a $500,000 investment, provided market conditions remain stable. If conditions shift, this amount may change, or the dividend discontinued altogether. Housing eligible dividend stocks in a registered account can help you keep more of the dividends you earn.

As its name suggests, investments grow tax-free within a TFSA. Earned dividend income is not taxable — a meaningful advantage in retirement when you rely on making regular withdrawals. Dividends held in an RRSP — which becomes a Registered Retirement Income Fund (RRIF) upon retirement — grow tax deferred and are considered income for tax purposes when withdrawn. However, contributions made while you’re still working reduce your taxable income in the same year, offering immediate benefits.

Non-registered accounts can also offer some advantages. For example, the Canadian Dividend Tax Credit reduces the tax burden on eligible dividends. With careful tax planning and active portfolio management, dividend-paying stocks can play an important role in diversifying an early retiree’s income portfolio.

Registered Accounts

Fixed-income investments

Simple and safe, many early retirees rely on fixed-income investments like Guaranteed Investment Certificates (GICs) or bonds to generate regular cash flow through earned interest, with the added benefit of helping to preserve their initial investment.

While widely considered a prudent investment vehicle for risk-averse investors, the returns and cash flow from fixed-income products can be modest, in line with their lower risk profile. In some years, your purchasing power may even decline — despite your investment technically growing on paper.

For example, Government of Canada bonds set the benchmark for the so-called “risk-free rate” that other investments are compared against, but currently yield only about 2.76% on a five-year coupon at a time when inflation hovers around 2%.

Fixed-income investments for early retirement

Fixed-income products like GICs and bonds fit naturally into registered accounts. In a TFSA, interest earned is completely tax-free, allowing retirees to withdraw income without increasing their taxable income for the year. In an RRSP — and later a RRIF — interest grows tax-deferred, though withdrawals are fully taxed as income, making careful planning important when converting to retirement income.

High-interest savings accounts

Offering a slight bump in interest compared to typical savings accounts, high-interest savings accounts (HISAs) are widely accessible, liquid, and protected by Canada Deposit Insurance up to applicable limits. In the investment world, they are considered one of the safest places to hold cash.

Like fixed-income assets, the trade-off for HISAs’ lower risk profile is that returns are usually modest. While your initial investment is protected, inflation and taxes can significantly reduce your real return over time.

Manage a rental property yourself

Buying a condo or duplex and renting it out has long been a Canadian wealth-building strategy. Monthly rental income can add up, especially in tight housing markets. Direct ownership also allows you to build equity over time, and your property may appreciate in value — even more so if you complete improvements like renovations.

From tenant issues to repairs and maintenance costs, direct ownership doesn’t always meet the definition of “passive income” for most people, let alone retirees. That said, being a landlord takes time, money, and energy, even when hiring third parties to manage a property for you.

Managing a rental property for early retirement income

While rental income is fully taxable, there are advantages for retirees. You may be able to deduct eligible expenses — such as repairs, utilities, and property management fees — which can help reduce your taxable income. If you hold the property for many years, you may also benefit from long-term appreciation, with capital gains tax only applied if and when you sell.

At the same time, costs such as mortgage payments can fluctuate with interest rates, and unexpected expenses can be difficult to plan for in retirement. Whatever remains after expenses is taxable as rental income, and the amount you owe will depend on your province and personal tax situation.

High-interest savings accounts

Offering a slight bump in interest compared to typical savings accounts, high-interest savings accounts (HISAs) are widely accessible, liquid, and protected by Canada Deposit Insurance up to applicable limits. In the investment world, they are considered one of the safest places to hold cash.

Like fixed-income assets, the trade-off for HISAs’ lower risk profile is that returns are usually modest. While your initial investment is protected, inflation and taxes can significantly reduce your real return over time.

Manage a rental property yourself

Buying a condo or duplex and renting it out has long been a Canadian wealth-building strategy. Monthly rental income can add up, especially in tight housing markets. Direct ownership also allows you to build equity over time, and your property may appreciate in value — even more so if you complete improvements like renovations.

From tenant issues to repairs and maintenance costs, direct ownership doesn’t always meet the definition of “passive income” for most people, let alone retirees. That said, being a landlord takes time, money, and energy, even when hiring third parties to manage a property for you.

Managing a rental property for early retirement income

While rental income is fully taxable, there are advantages for retirees. You may be able to deduct eligible expenses — such as repairs, utilities, and property management fees — which can help reduce your taxable income. If you hold the property for many years, you may also benefit from long-term appreciation, with capital gains tax only applied if and when you sell.

At the same time, costs such as mortgage payments can fluctuate with interest rates, and unexpected expenses can be difficult to plan for in retirement. Whatever remains after expenses is taxable as rental income, and the amount you owe will depend on your province and personal tax situation.

Retirement Planning Made Easy With Private

Real Estate Investments

Private real estate funds

Here’s a strategy most investors don’t know about — and one that’s changing the game for passive income. Private real estate investment funds allow everyday people to invest in income-generating properties — without the work of being a landlord. Some funds focus on certain kinds of properties, such as multifamily (rental apartments), commercial, retail, or industrial, or a mix of several.

Equiton’s flagship Apartment Fund (Equiton Residential Income Fund Trust) gives you access to a portfolio of multifamily rental apartments, a tried-and-true asset class that has demonstrated strong fundamentals for decades. Investors can focus on their investment goals, while we handle the rest: property selection, management, tenant relations, and maintenance, with the objective of delivering regular income.

Private real estate funds tend to target distributions yields well above other popular passive income sources but are also generally considered riskier investments. Your distributions are highly dependent on market and economic conditions and are considered illiquid investments. Like many other private investments, they are not traded on the public market and are subject to different rules around transparency and disclosure.

Real estate funds for early retirement

In addition to helping you avoid landlord duties in retirement, private real estate investments like the Apartment Fund can often be held in a TFSA or other retirement accounts, meaning you enjoy the same tax benefits extended to other eligible investments. That said, private real estate can be a tax-efficient choice even within a non-registered account. Funds may classify all or a portion of distributions as Return of Capital, allowing you to defer taxes on that portion of your earnings until the year you sell the investment.

How to build your early retirement income stack

Together with pensions available to retired Canadians, a passive income portfolio can help diversify where your money comes from in retirement. Some investments may offer the potential for higher income but come with higher risk, while others are more likely to provide steadier returns with less volatility. Balancing both, you can work toward a more predictable income that you can plan around.

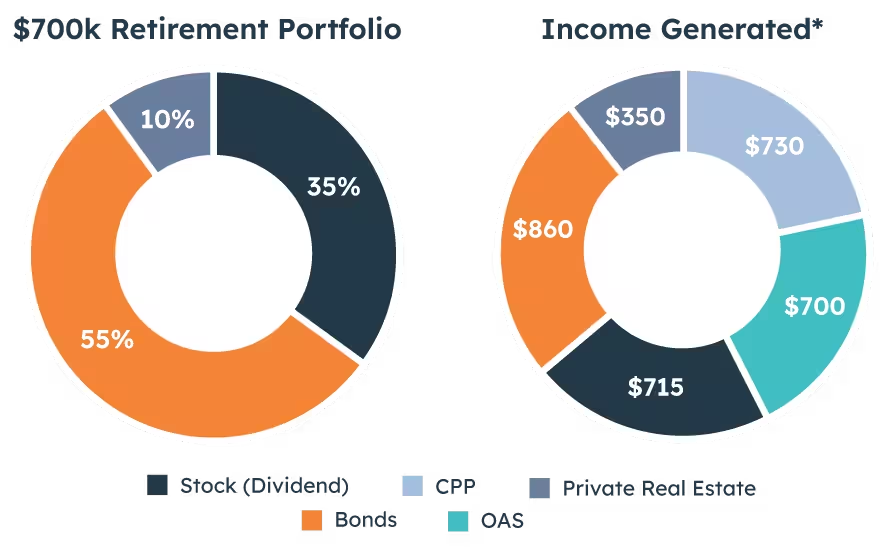

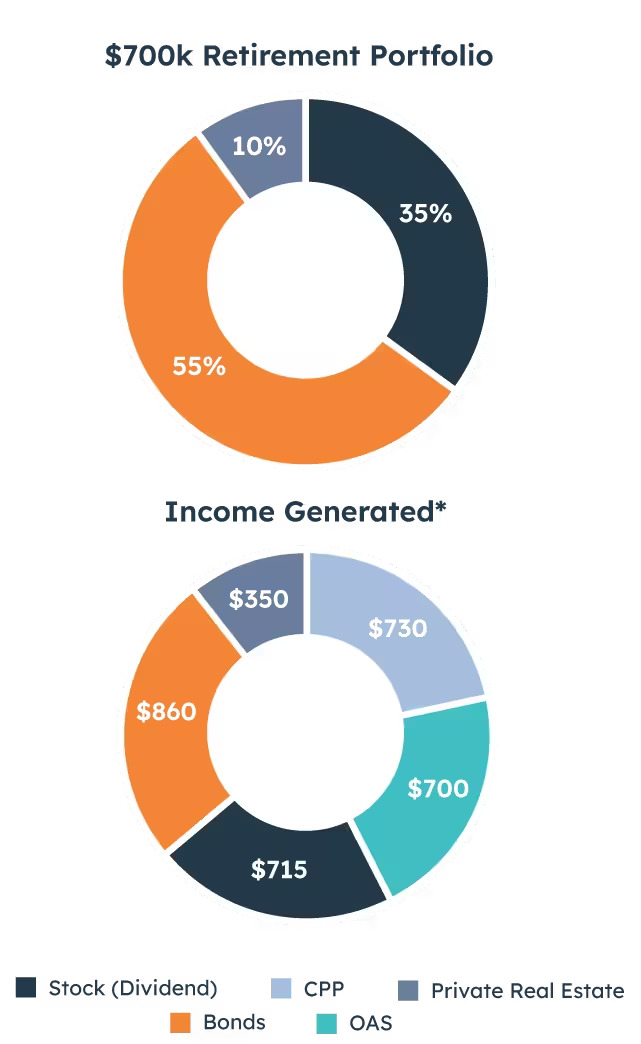

Consider this hypothetical monthly income stack based on a simplified passive income portfolio valued at $700k:

Total monthly income: $3,355

*Assumes average CPP and OAS payments at age 65, 3.5% dividend yield, 2.7% bond yield, 6% real estate fund yield. This model portfolio is provided for illustrative purposes only and does not constitute advice. For more information, please speak to an investment professional.

In this example, you might receive $1,430 in combined pension income on top of $1,925 from your passive income sources. If income from one asset fluctuates, your other investments may offer some stability — and vice versa. Meanwhile, a GIC or high-interest savings account can be used to preserve your original investment, regardless of market and economic conditions, while potentially generating returns after inflation.

By planning the right balance for your unique lifestyle, comfort level, and income needs, you can create an investment mix that works for your personal retirement goals. Booking some time with an investment professional is a crucial step to help you assess your situation and the investments most likely to help you get there.

Private real estate funds

Here’s a strategy most investors don’t know about — and one that’s changing the game for passive income. Private real estate investment funds allow everyday people to invest in income-generating properties — without the work of being a landlord. Some funds focus on certain kinds of properties, such as multifamily (rental apartments), commercial, retail, or industrial, or a mix of several.

Equiton’s flagship Apartment Fund (Equiton Residential Income Fund Trust) gives you access to a portfolio of multifamily rental apartments, a tried-and-true asset class that has demonstrated strong fundamentals for decades. Investors can focus on their investment goals, while we handle the rest: property selection, management, tenant relations, and maintenance, with the objective of delivering regular income.

Private real estate funds tend to target distributions yields well above other popular passive income sources but are also generally considered riskier investments. Your distributions are highly dependent on market and economic conditions and are considered illiquid investments. Like many other private investments, they are not traded on the public market and are subject to different rules around transparency and disclosure.

Real estate funds for early retirement

In addition to helping you avoid landlord duties in retirement, private real estate investments like the Apartment Fund can often be held in a TFSA or other retirement accounts, meaning you enjoy the same tax benefits extended to other eligible investments. That said, private real estate can be a tax-efficient choice even within a non-registered account. Funds may classify all or a portion of distributions as Return of Capital, allowing you to defer taxes on that portion of your earnings until the year you sell the investment.

How to build your early retirement income stack

Together with pensions available to retired Canadians, a passive income portfolio can help diversify where your money comes from in retirement. Some investments may offer the potential for higher income but come with higher risk, while others are more likely to provide steadier returns with less volatility. Balancing both, you can work toward a more predictable income that you can plan around.

Consider this hypothetical monthly income stack based on a simplified passive income portfolio valued at $700k:

Total monthly income: $3,355

*Assumes average CPP and OAS payments at age 65, 3.5% dividend yield, 2.7% bond yield, 6% real estate fund yield. This model portfolio is provided for illustrative purposes only and does not constitute advice. For more information, please speak to an investment professional.

In this example, you might receive $1,430 in combined pension income on top of $1,925 from your passive income sources. If income from one asset fluctuates, your other investments may offer some stability — and vice versa. Meanwhile, a GIC or high-interest savings account can be used to preserve your original investment, regardless of market and economic conditions, while potentially generating returns after inflation.

By planning the right balance for your unique lifestyle, comfort level, and income needs, you can create an investment mix that works for your personal retirement goals. Booking some time with an investment professional is a crucial step to help you assess your situation and the investments most likely to help you get there.

Curious how real estate income fits your plan?

Book a free consultation to explore monthly distribution options.

No matter when you envision retiring, the time to start planning your passive income investments is now. It’s important to understand your expectations for retirement, which investments are suitable for you, and the balance of risk and reward that will keep you comfortable. To help you get started, we’ve prepared an Income Planning Worksheet that shows how different investment types can fit into your vision for retirement.

Download our Income Planning Worksheet or Book a Consultation.

Frequently Asked Questions

You can retire at any age if you have sufficient personal savings, but government pensions have specific ages: CPP can start at 60 (with a 36% reduction), and OAS begins at 65 with no early option. Many workplace pensions allow retirement at 55.

Starting CPP at age 60 results in a permanent 36% reduction. This is calculated as 0.6% per month for the 60 months before age 65. A $1,000 monthly benefit at 65 becomes $640 at age 60.

CPP is a pension you earn through working and contributing during your career – the amount depends on your contributions. OAS is a government benefit you qualify for by living in Canada for 10+ years after age 18, regardless of work history.

Early retirees typically use private health insurance ($200-500+/month), continue employer coverage through retirement benefits if available, rely on a spouse’s plan, or budget for out-of-pocket healthcare expenses until provincial senior benefits become available.

Curious how real estate income fits your plan?

Book a free consultation to explore monthly distribution options.

No matter when you envision retiring, the time to start planning your passive income investments is now. It’s important to understand your expectations for retirement, which investments are suitable for you, and the balance of risk and reward that will keep you comfortable. To help you get started, we’ve prepared an Income Planning Worksheet that shows how different investment types can fit into your vision for retirement.

Download our Income Planning Worksheet or Book a Consultation.

Frequently Asked Questions

You can retire at any age if you have sufficient personal savings, but government pensions have specific ages: CPP can start at 60 (with a 36% reduction), and OAS begins at 65 with no early option. Many workplace pensions allow retirement at 55.

Starting CPP at age 60 results in a permanent 36% reduction. This is calculated as 0.6% per month for the 60 months before age 65. A $1,000 monthly benefit at 65 becomes $640 at age 60.

CPP is a pension you earn through working and contributing during your career – the amount depends on your contributions. OAS is a government benefit you qualify for by living in Canada for 10+ years after age 18, regardless of work history.

Early retirees typically use private health insurance ($200-500+/month), continue employer coverage through retirement benefits if available, rely on a spouse’s plan, or budget for out-of-pocket healthcare expenses until provincial senior benefits become available.