Securing Your Future: How Private Real Estate Can Transform Retirement into Financial Freedom

Table of Contents

Retirement Planning is Changing

For decades, investors relied primarily on stocks and bonds to grow their savings. But in today’s environment, those traditional tools often aren’t enough to deliver the consistent growth and stability retirees need.

That’s why institutional investors—pension funds, endowments, and other large plans—have long turned to alternative assets such as private equity, real estate, and infrastructure. Now, these same strategies are becoming more accessible to everyday investors.

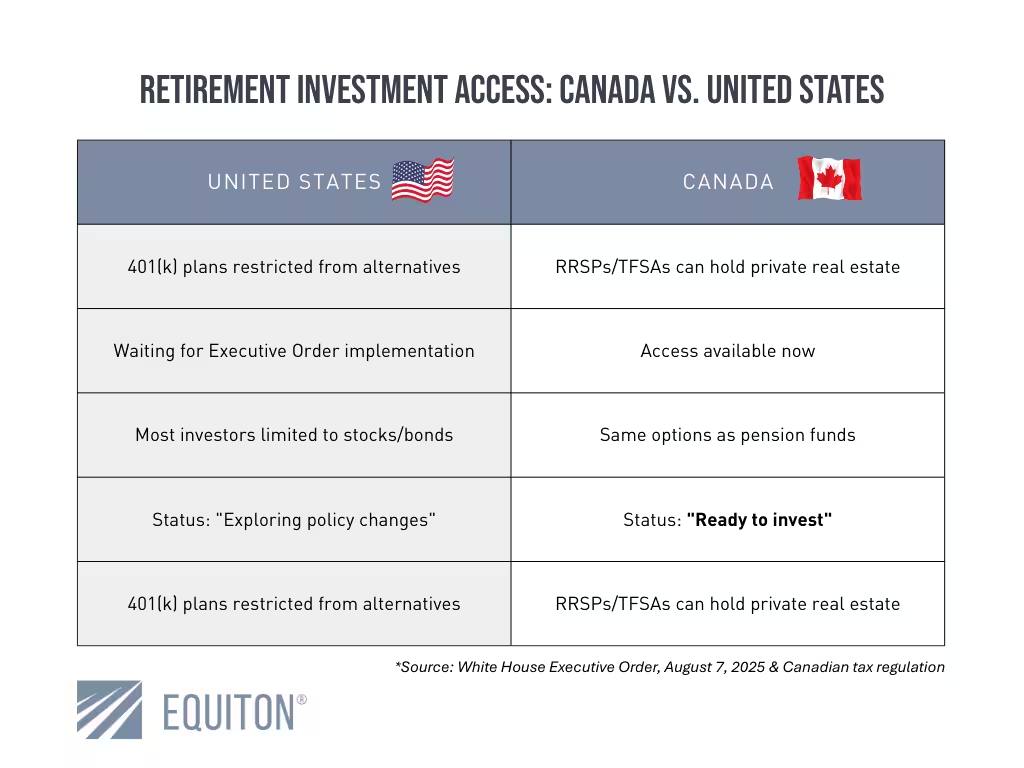

In the U.S., momentum is building quickly. On August 7, 2025, the White House issued an Executive Order titled “Democratizing Access to Alternative Assets for 401(k) Investors.” While this directive does not automatically permit private assets in 401(k) plans, it directs federal agencies to explore the issue and consider potential changes that could open the door to alternatives such as private equity, real estate, and private credit.

Even at this exploratory stage, the move is significant on a global scale. If the world’s largest retirement system ultimately embraces alternatives, it would signal a fundamental shift in how people everywhere think about building wealth for the future. It would validate what institutions have practiced for decades: that alternatives—particularly real estate—are no longer optional, but essential for long-term retirement success.

Retirement Planning is Changing

For decades, investors relied primarily on stocks and bonds to grow their savings. But in today’s environment, those traditional tools often aren’t enough to deliver the consistent growth and stability retirees need.

That’s why institutional investors—pension funds, endowments, and other large plans—have long turned to alternative assets such as private equity, real estate, and infrastructure. Now, these same strategies are becoming more accessible to everyday investors.

In the U.S., momentum is building quickly. On August 7, 2025, the White House issued an Executive Order titled “Democratizing Access to Alternative Assets for 401(k) Investors.” While this directive does not automatically permit private assets in 401(k) plans, it directs federal agencies to explore the issue and consider potential changes that could open the door to alternatives such as private equity, real estate, and private credit.

Even at this exploratory stage, the move is significant on a global scale. If the world’s largest retirement system ultimately embraces alternatives, it would signal a fundamental shift in how people everywhere think about building wealth for the future. It would validate what institutions have practiced for decades: that alternatives—particularly real estate—are no longer optional, but essential for long-term retirement success.

The Bigger Picture

The Executive Order is designed to break down barriers and modernize retirement investing. Here are three key ways it aims to reshape the landscape:

Leveling the playing field – Ultra-wealthy individuals and large pension funds already access alternative assets, but most everyday 401(k) investors can’t. The order aims to expand access, so retirement savers aren’t left behind.

Improving retirement outcomes – By adding alternative assets, like private real estate, investors could gain better diversification and potentially benefit from higher risk-adjusted returns.

Making it simpler to expand choices – The order encourages government agencies to give clearer guidelines, making it easier for employers to add more types of investments to 401(k) plans. This means employees could have a wider range of options to help grow their retirement savings.

Pension Funds Already Capitalize on the Private Real Estate Investment Strategy

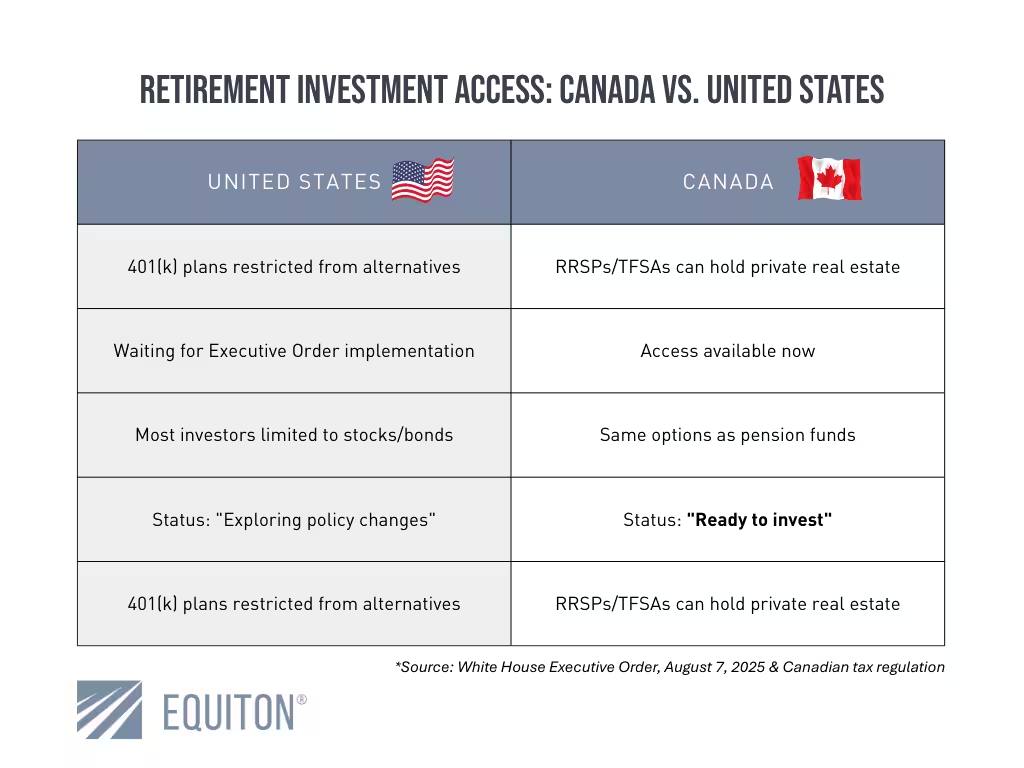

Canadians and their pension plans already employ alternative investments as a key element of their portfolios. Beyond, Canadian RRSPs and TFSAs can hold alternative investments, including private real estate funds.

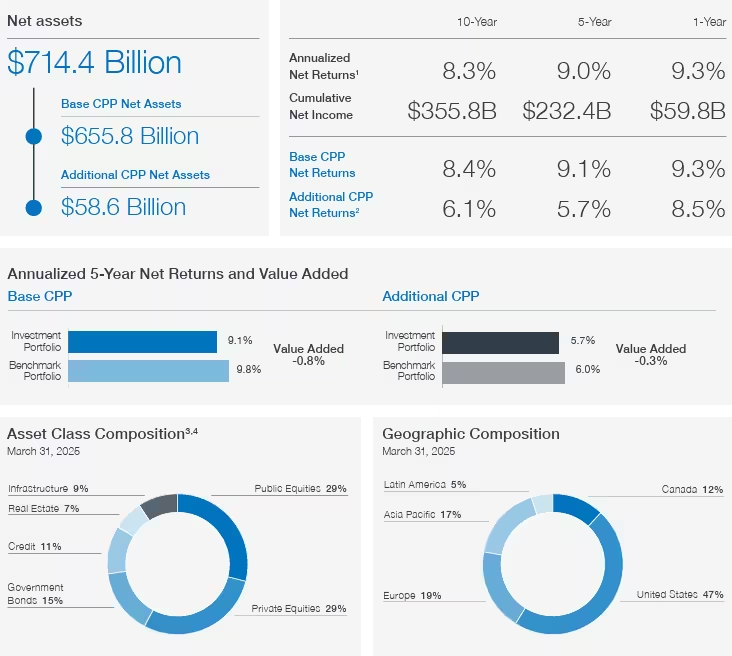

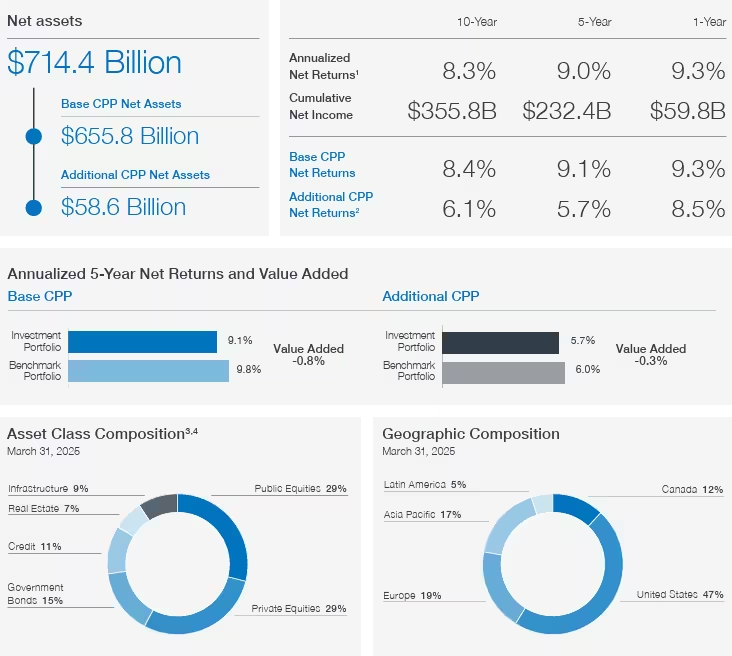

Major Canadian pension funds like the Canadian Pension Plan (CPP) and the Ontario Teachers’ Pension Plan already allocate over 53% to alternatives (infrastructure 9%, Private Equity 26%, Real Estate 7% and Credit 11%) – this isn’t experimental, it’s a proven strategy.

The US Executive Order validates what these Canadian institutions have practiced for decades and highlights the opportunity that eligible Canadian investors already have the ability to act on now.

Why Private Real Estate Can Work for Long-Term Portfolios

While the executive order includes a wide range of alternative investments, private real estate deserves special attention.

- Tangible Value – Unlike digital assets, real estate is backed by physical properties that often generate steady income.

- Demand Drivers – In Canada, population growth, immigration, and housing shortages continue to support long-term resilience in real estate markets.

- Inflation Hedge – Rental income has historically risen with inflation, helping preserve purchasing power in retirement.

Image & Statistic Source: CPP Investments 2025 Annual Report. Page 35 of 46

The Bigger Picture

The Executive Order is designed to break down barriers and modernize retirement investing. Here are three key ways it aims to reshape the landscape:

Leveling the playing field – Ultra-wealthy individuals and large pension funds already access alternative assets, but most everyday 401(k) investors can’t. The order aims to expand access, so retirement savers aren’t left behind.

Improving retirement outcomes – By adding alternative assets, like private real estate, investors could gain better diversification and potentially benefit from higher risk-adjusted returns.

Making it simpler to expand choices – The order encourages government agencies to give clearer guidelines, making it easier for employers to add more types of investments to 401(k) plans. This means employees could have a wider range of options to help grow their retirement savings.

Pension Funds Already Capitalize on the Private Real Estate Investment Strategy

Canadians and their pension plans already employ alternative investments as a key element of their portfolios. Beyond, Canadian RRSPs and TFSAs can hold alternative investments, including private real estate funds.

Major Canadian pension funds like the Canadian Pension Plan (CPP) and the Ontario Teachers’ Pension Plan already allocate over 53% to alternatives (infrastructure 9%, Private Equity 26%, Real Estate 7% and Credit 11%) – this isn’t experimental, it’s a proven strategy.

The US Executive Order validates what these Canadian institutions have practiced for decades and highlights the opportunity that eligible Canadian investors already have the ability to act on now.

Why Private Real Estate Can Work for Long-Term Portfolios

While the executive order includes a wide range of alternative investments, private real estate deserves special attention.

- Tangible Value – Unlike digital assets, real estate is backed by physical properties that often generate steady income.

- Demand Drivers – In Canada, population growth, immigration, and housing shortages continue to support long-term resilience in real estate markets.

- Inflation Hedge – Rental income has historically risen with inflation, helping preserve purchasing power in retirement.

Image & Statistic Source: CPP Investments 2025 Annual Report. Page 35 of 46

Retirement Planning Made Easy With Private

Real Estate Investments

Retirement Planning Made Easy With Private

Real Estate Investments

Private Real Estate Investment Strategies for Canadians

Long-Term Benefits of Property Investment

History shows that values and rental income generally trend upward over time. This makes real estate a natural fit for retirement planning, offering stability, consistent growth, and the potential to preserve and build wealth across market cycles.

Monthly Income Plus Appreciation Potential

Real estate often provides regular cash distributions through rental income, while properties may appreciate in value.

Diversification Within Real Estate

Multi-residential buildings, development projects, and commercial assets each respond differently to economic forces. Spreading capital across different areas can increase portfolio diversification and lower risk.

How Canadian Investors Access These Opportunities

This change sets the stage for something we have been championing for over a decade—using private real estate as a powerful wealth-building tool leading up to, and into, retirement. While the U.S. Executive Order opens the door for alternatives to be added into employer-sponsored retirement plans, Equiton already provides Canadians with access to institutional-quality real estate designed to help build and preserve wealth for the long term.

Here’s how Equiton makes this approach to retirement wealth accessible and actionable for investors:

- Exclusive Real Estate Focus – From multi-residential properties to development opportunities, Equiton specializes in the full spectrum of private real estate. Our leadership brings decades of hands-on experience across development, multi-residential, and commercial real estate, ensuring expertise drives every investment decision.

- Proven Ability to Build Value – We take a hands-on, personalized approach to managing investments, giving us strong market knowledge and a clear understanding of both current and future opportunities.

- Diversified Funds – Exposure to multi-residential, commercial, and development projects spreads risk across geographies and sectors.

- Built for Everyday Investors – Unlike traditional private equity requiring millions in minimums, Equiton makes these opportunities accessible to investors seeking retirement growth, starting with a $25,000 minimum investment.

Private Real Estate Investment Strategies for Canadians

Long-Term Benefits of Property Investment

History shows that values and rental income generally trend upward over time. This makes real estate a natural fit for retirement planning, offering stability, consistent growth, and the potential to preserve and build wealth across market cycles.

Monthly Income Plus Appreciation Potential

Real estate often provides regular cash distributions through rental income, while properties may appreciate in value.

Diversification Within Real Estate

Multi-residential buildings, development projects, and commercial assets each respond differently to economic forces. Spreading capital across different areas can increase portfolio diversification and lower risk.

How Canadian Investors Access These Opportunities

This change sets the stage for something we have been championing for over a decade—using private real estate as a powerful wealth-building tool leading up to, and into, retirement. While the U.S. Executive Order opens the door for alternatives to be added into employer-sponsored retirement plans, Equiton already provides Canadians with access to institutional-quality real estate designed to help build and preserve wealth for the long term.

Here’s how Equiton makes this approach to retirement wealth accessible and actionable for investors:

- Exclusive Real Estate Focus – From multi-residential properties to development opportunities, Equiton specializes in the full spectrum of private real estate. Our leadership brings decades of hands-on experience across development, multi-residential, and commercial real estate, ensuring expertise drives every investment decision.

- Proven Ability to Build Value – We take a hands-on, personalized approach to managing investments, giving us strong market knowledge and a clear understanding of both current and future opportunities.

- Diversified Funds – Exposure to multi-residential, commercial, and development projects spreads risk across geographies and sectors.

- Built for Everyday Investors – Unlike traditional private equity requiring millions in minimums, Equiton makes these opportunities accessible to investors seeking retirement growth, starting with a $25,000 minimum investment.

The Future of Alternative Retirement Investing

This Executive Order sets the stage on a global scale for building retirement wealth through private real estate—something we’ve believed to be critical for over a decade. What was once considered an alternative is now being recognized worldwide as a mainstream strategy for long-term financial security.

With Equiton, eligible investors already have access to institutional-quality private real estate—unlocking the growth potential, diversification, and income that leading institutions across the globe rely on.

We’re proud to be at the forefront of this movement, making private real estate accessible and helping shape the future of retirement investing.

Interested in learning how private real estate can strengthen your retirement plan? Explore Equiton’s investment funds and discover how to put your money to work in the most resilient real estate markets.

Frequently Asked Questions

Yes, our funds are eligible for registered accounts.

Investments start at $25,000.

Varies by fund – some offer redemptions after 3 years with fees, others are hold-to-completion.

All investments carry risk. Among other risks, private real estate involves liquidity constraints and market risk. Please refer to the offering memorandum for details, including risk factors.

The Future of Alternative Retirement Investing

This Executive Order sets the stage on a global scale for building retirement wealth through private real estate—something we’ve believed to be critical for over a decade. What was once considered an alternative is now being recognized worldwide as a mainstream strategy for long-term financial security.

With Equiton, eligible investors already have access to institutional-quality private real estate—unlocking the growth potential, diversification, and income that leading institutions across the globe rely on.

We’re proud to be at the forefront of this movement, making private real estate accessible and helping shape the future of retirement investing.

Interested in learning how private real estate can strengthen your retirement plan? Explore Equiton’s investment funds and discover how to put your money to work in the most resilient real estate markets.

Frequently Asked Questions

Yes, our funds are eligible for registered accounts.

Investments start at $25,000.

Varies by fund – some offer redemptions after 3 years with fees, others are hold-to-completion.

All investments carry risk. Among other risks, private real estate involves liquidity constraints and market risk. Please refer to the offering memorandum for details, including risk factors.