Real Estate Investing Helps Mitigate Market Volatility

Every investor is worried when they hear the term “volatility” in relation to the market. It’s a word that often has unnerving connotations. With that said, market volatility can be less of a concern if you’ve structured your portfolio properly. It’s widely known that a good portfolio starts with good investments but when the market turns volatile, it can be difficult to tell what constitutes a “good” investment.

WHAT IS VOLATILITY?

Volatility means a tendency to change quickly and unpredictably. Regarding the stock market, it generally refers to the frequency and degree of price movements, either up or down. The bigger the shifts and the more often the price swings, the more volatile the market is said to be. It seems Canadians will need to adapt to more uncertainty as “everyday volatility” appears to be the new norm, according to Stephen Poloz, former governor of the Bank of Canada.

NAVIGATING Market Volatility

You don’t have to just sit back and hope that the market lands in a favourable position. There are things you can do to safeguard against volatility. The market may not be in your control, but your portfolio is. Since private real estate isn’t typically impacted by fluctuations in the stock market, it can offer your portfolio true diversification and potentially better risk-adjusted returns over the long run.

It’s no wonder that real estate has the reputation of being recession-proof. For the savvy investor, buying alternative assets, such as private real estate investment trusts (REITs), can provide a counterweight to the uncertainty of the market and help mitigate volatility.

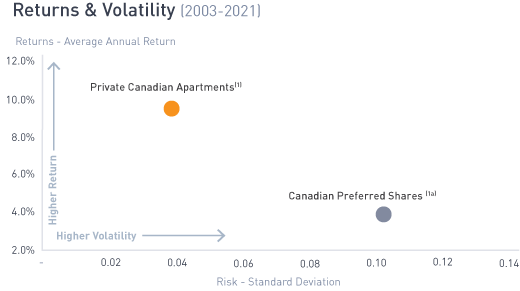

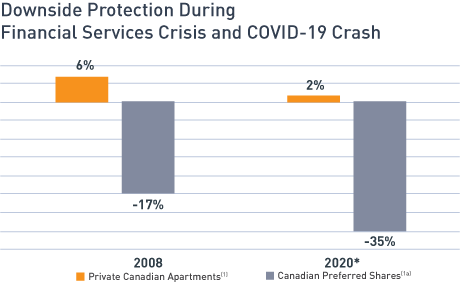

According to Forbes, REITs add an important diversification to your portfolio as they primarily generate dividend income for their investors and reliable risk-adjusted returns. Not only have Private Canadian Apartments1 performed better than Canadian Preferred Shares, but they’ve also been significantly less volatile with a return of 9.2% between 2003-2021 compared to 4.1% for Canadian Preferred Shares1a. During the COVID-19 crash in 2020, Private Canadian Apartments actually increased by 2% while Canadian Preferred Shares fell by 35%.2

*Data based on Sharpe Ratio. NOTE: the higher the Sharpe Ratio, the better the investment’s historical risk-adjusted performance has been.

GET BACK SOME CONTROL

No one likes to feel like they don’t have any control especially when it comes to their hard-earned money. Diversifying your portfolio to include alternative investments like private REITs can provide a much-needed counterweight to the fluctuations in other sectors of the market.

At Equiton, we believe that diversifying your portfolio with private real estate investments offers an attractive opportunity with stability of yield, inflation protection, and growth potential. This provides investors with regular income distributions as well as asset value appreciation. In a volatile market, having an investment that performs consistently and offers stability can make all the difference.

Using your money wisely is the best way to ensure your financial future and ride out market volatility.

You’re in control. Show it by making sound decisions about your portfolio.

To learn more about how private REITs could help guard your portfolio against volatility, email Equiton today at inquiries@equiton.com.

1 Private Canadian Apartments = MSCI/REALPAC Canada Quarterly Property Fund Index- Residential / MSCI Real Estate Analytics Portal– Accessed January 28, 2022

1a Public Canadian Preferred Shares = S&P/TSX Capped REIT Total Return Index / Bloomberg – Accessed January 28, 2022

2 December 31, 2019 to March 23, 2020